How Can We Help?

Accounting and Financial Policies and Procedures Manual

Accounting and Financial Policies and Procedures Manual

Approved and Published: February 2019

Introduction

The following accounting manual is intended to provide an overview of the accounting policies and procedures applicable to the Central Oklahoma Workforce Investment Board, Inc., which shall be referred to as “Central Oklahoma Workforce Innovation Board (COWIB)” or “the Organization” throughout this manual.

The Central Oklahoma Workforce Investment Board/dba the Central Oklahoma Workforce Innovation Board is incorporated in the state of Oklahoma. Central Oklahoma Workforce Innovation Board is exempt from Federal income taxes under IRS Section 501(c)(3) as a nonprofit corporation. Central Oklahoma Workforce Innovation Board’s mission is as follows:

Improving lives in our communities by building a quality workforce through education and creating connections between Job Seekers and Businesses

This manual shall document the financial operations of the Organization. Its primary purpose is to formalize accounting policies and selected procedures for the accounting staff and to document internal controls.

The Board approved the contents of this manual as official policy of the Organization. All Central Oklahoma Workforce Innovation Board staff are bound by the policies herein, and any deviation from established policy is prohibited. The CEO has the authority to change the policy as it may be required by federal, state or local regulations or policies.

General Policies

Organizational Structure

The Role of the Board

The Central Oklahoma Workforce Innovation Board is governed by its Board of Directors, which is responsible for the oversight of the Organization by:

- Planning for the future

- Establishing broad policies

- Identifying and proactively dealing with emerging issues

- Interpreting the Organization’s mission to the public

- Contracting for the Chief Executive Officer

- Establishing and maintaining programs and systems designed to assure compliance with terms of contracts and grants

The Board is responsible for hiring and periodically evaluating the Organization’s Chief Executive Officer, who shall be responsible for the day-to-day oversight and management of Central Oklahoma Workforce Innovation Board.

Committee Structure

The Board shall form committees in order to assist the Board in fulfilling its responsibilities. These committees represent vehicles for parceling out the Board’s work to smaller groups, thereby removing the responsibility for evaluating all of the details of particular issues from the full Board’s consideration. Ad hoc committees that are time and focus limited may be created from time to time to act on specific functions for the organization. Formal Committees of Central Oklahoma Workforce Innovation Board consist of the following:

- Executive Committee

- Finance Committee

- System Partners Committee

- Youth Council

Specific guidelines regarding the composition and election of the Board and committees are described in the Organization’s by-laws. However, roles of committees with direct responsibilities for the financial affairs of the Organization are further described in this manual. These committees shall be referred to in appropriate sections of this manual.

Finance Committee Responsibilities

The Finance Committee is responsible for direction and oversight regarding the overall financial management of Central Oklahoma Workforce Innovation Board. Functions of the Finance Committee include:

Review program budgets and expenditures, review audit reports, and financial aspects of program monitoring reports, making recommendations as needed.

The Finance Committee is responsible for recommending the hiring of an independent CPA firm. The Controller and Chief Executive Officer are responsible for directly communicating with the CPA firm to fulfill the requirement for an annual audit, as described in the Organization’s by-laws. The Finance Committee shall also review and approve the final audited financial statements, as well as any communications received from the auditor regarding internal controls, illegal acts, or fraud. The review of the Organization’s financial statements shall not be limited to the finance committee, but shall involve the entire Board.

The Finance Committee’s role in the annual audit is more fully explained in the section of this manual covering the annual audit.

The Roles of the Chief Executive Officer and Staff

The Board hires the Chief Executive Officer, who reports directly to the Board. The Chief Executive Officer is responsible for the hiring and annual evaluation of all employees of the agency. The Chief Executive Officer may delegate this responsibility to any other employee as needed.

Chief Operations Officer (COO) and Program Managers’ Responsibilities

The COO and Program Managers are responsible for the proper oversight of program expenditures of grant funds incident to their area of responsibility and in accordance with funding source guidelines and Agency fiscal policies. They are further responsible for the management of allocated funds; ensuring funds stay within line items in their budget, and authorizing the proper funding source and category in discharging financial obligations to the Accounting Department. The development of program budgets is the responsibility of the Chief Executive Officer with final approval by the Board and Board of Chief Elected Officials (BCEO). Programmatic records will be retained for a period of three years after the audit and/or resolution of any audit related findings.

Fiscal Management Responsibilities

The Chief Executive Officer is responsible for establishing and administering procedures necessary to comply with the Fiscal Policies of the Board and the various funding sources. Coordination shall exist between the Chief Executive Officer, Controller, the BCEO and the Officers of the Board. Specific responsibilities include the maintenance of financial records, payment of bills, payrolls and all standard accounting methods. In addition, the processing of monthly financial statements and financial projections for the Chief Executive Officer shall be accomplished by the Controller. Procedures established are directed towards the accountability of all funds received and disbursed on behalf of the agency and its mission.

It shall be the responsibility of the Controller to retain all financial records for a period of three years after the audit and/or resolution of any audit related findings.

Employees’ Responsibilities

All employees of the agency are responsible for the timely and accurate completion of fiscal documents and forms. These should be completed in an efficient, cost effective manner ensuring that public funds are properly expended toward achievement of the mission of the agency.

Accounting Department Overview

Organization

The accounting department consists of two (2) staff that manages and processes financial information for Central Oklahoma Workforce Innovation Board, the South Central Oklahoma Workforce Development Board and the Western Oklahoma Workforce Development Board. The positions comprising the accounting department of Central Oklahoma Workforce Innovation Board. are as follows:

- Controller

- Accounting Assistant

Other officers and employees of Central Oklahoma Workforce Innovation Board. who have financial responsibilities, and the abbreviations of each position used throughout this manual, are as follows:

- Chief Executive Officer (CEO)

- Chief Operations Officer (COO)

- Executive Committee (EC)

- Finance Committee (FC)

Responsibilities

The primary responsibilities of the accounting department consist of:

1. General Ledger

2. Cash and Innovation Management

3. Grants and Contracts Administration

4. Accounts Receivable and Billing

5. Accounts Payable

6. Financial Statement Processing

7. External Reporting of Financial Information

8. Reconciliation of Sub-Ledgers

9. Leases

10. Compliance with Government Reporting Requirements

11. Budgeting

12. Asset Management

13. Purchasing

14. Cash Receipts

15. Cash Disbursements

16. Payroll and Benefits

17. Bank Reconciliation

18. Annual Audit

19. Insurance

Business Conduct

Practice of Ethical Behavior

Unethical actions, or the appearance of unethical actions, are unacceptable under any conditions. The policies and reputation of Central Oklahoma Workforce Innovation Board depend to a very large extent on the following considerations.

Each employee must apply his/her own sense of personal ethics, which should extend beyond compliance with applicable laws and regulations in business situations, to govern behavior where no existing regulation provides a guideline. It is each employee’s responsibility to apply common sense in business decisions where specific rules do not provide all the answers. (see employees’ code of conduct)

Chief Executive Officer is responsible for the ethical business behavior of his/her subordinates and must weigh carefully all courses of action suggested in ethical, as well as economic terms, and base his/her final decisions on the guidelines provided by this policy, as well as his/her personal sense of right and wrong.

Conflicts of Interest

In addition, no employee, officer, agent or member of the board of Central Oklahoma Workforce Innovation Board shall participate in the selection, award, or administration of a contract involving Central Oklahoma Workforce Innovation Board if a real or apparent conflict of interest would be involved. Such a conflict would arise when the employee, officer, or agent, or any member of his/her immediate family, his or her partner, or an Organization that employs or is about to employ any of the parties indicated herein, has a financial or other interest in the firm selected. All employees and Board Members are required to sign a conflict of interest form.

Compliance with Laws, Regulations, and Organization Policies

The Central Oklahoma Workforce Innovation Board does not tolerate the willful violation or circumvention of any Federal, state, local, or foreign law by an employee during the course of that person’s employment; nor does the Organization tolerate the disregard or circumvention of Central Oklahoma Workforce Innovation Board policy or engagement in unscrupulous dealings. Employees should not attempt to accomplish by indirect means, through agents, or intermediaries, that which is directly forbidden.

Implementation of the provisions of this policy is one of the standards by which the performance of all levels of employees will be measured.

Disciplinary Action

Failure to comply with the standards contained in this policy or any other policy will result in disciplinary action that may include termination, referral for criminal prosecution, and reimbursement to the Organization or to the government, for any loss or damage resulting from the violation. As with all matters involving disciplinary action, principles of fairness will apply. Any employee charged with a violation of this policy will be afforded an opportunity to explain her/his actions before disciplinary action is taken.

Disciplinary action will be taken:

1. Against any employee who authorizes or participates directly in actions that are a violation of this policy.

2. Against any employee who has deliberately failed to report a violation or deliberately withheld relevant and material information concerning a violation of this policy.

3. Against any employee who attempts to retaliate, directly or indirectly, or encourages others to do so, against any employee who reports a violation of this policy.

Fraud Policy

Scope

This policy applies to any fraud or suspected fraud involving employees, officers or directors, as well as members, vendors, consultants, contractors, funding sources and/or any other parties with a business relationship with Central Oklahoma Workforce Innovation Board. Any investigative activity required will be conducted without regard to the suspected wrongdoer’s length of service, position/title, or relationship with Central Oklahoma Workforce Innovation Board.

Policy

Management is responsible for the detection and prevention of fraud, misappropriations, and other irregularities. Fraud is defined as the intentional, false representation or concealment of a material fact, or the intentional perversion of truth in order to induce another to part with something of value. Each member of the management team will be familiar with the types of improprieties that might occur within his or her area of responsibility, and be alert for any indication of irregularity.

Any fraud that is detected or suspected must be reported immediately to the Chief Executive Officer, Controller or, alternatively, to the Chair of the Central Oklahoma Workforce Innovation Board, who coordinates all investigations.

Actions Constituting Fraud

The terms fraud, defalcation, misappropriation, and other fiscal irregularities refer to, but are not limited to:

1. Any dishonest or fraudulent act

2. Forgery or alteration of any document or account belonging to Central Oklahoma Workforce Innovation Board

3. Forgery or alteration of a check, bank draft, or any other financial document

4. Misappropriation of funds, securities, supplies, equipment, or other assets of Central Oklahoma Workforce Innovation Board

5. Impropriety in the handling or reporting of money or financial transactions

6. Disclosing confidential and proprietary information to outside parties

7. Accepting or seeking anything of material value from contractors, vendors, or persons providing goods or services to Central Oklahoma Workforce Innovation Board. Exception: gifts less than a material value.

8. Destruction, removal or inappropriate use of records, furniture, fixtures, and equipment

9. Any similar or related irregularity

Other Irregularities

Irregularities concerning an employee’s moral, ethical, or behavioral conduct should be resolved by the departmental management and the Chief Executive Officer.

If there is a question as to whether an action constitutes fraud, contact the Chief Executive Officer or the Board Chair for guidance.

Investigation Responsibilities

The Executive Committee has the primary responsibility for the investigation of all suspected fraudulent acts as defined in the policy. The Executive Committee may utilize whatever internal and/or external resources it considers necessary in conducting an investigation. If an investigation substantiates that fraudulent activities have occurred, the Executive Committee will issue reports to the Central Oklahoma Workforce Innovation Board.

Decisions to prosecute or refer the examination results to the appropriate law enforcement and/or regulatory agencies for independent investigation will be made in conjunction with legal counsel and senior management, as will final dispositions of the case.

If suspected fraud or other wrongdoing involves programs funded in whole or in part with Federal funds, additional responsibilities, such as special reporting and disclosure to the awarding agency, may apply to the Organization. It is the policy of Central Oklahoma Workforce Innovation Board to fully comply with all additional reporting, disclosure, and other requirements pertaining to suspected acts of fraud as described in award documents.

Confidentiality

The Executive Committee and the Chief Executive Officer shall treat all information received as confidential. Any employee who suspects dishonest or fraudulent activity will notify the Chief Executive Officer or the Board Chair immediately, and should not attempt to personally conduct investigations or interviews/interrogations related to any suspected fraudulent act (see Reporting Procedures section below).

Investigation results will not be disclosed or discussed with anyone other than those who have a legitimate need to know. This is important in order to avoid damaging the reputations of persons suspected but subsequently found innocent of wrongful conduct and to protect Central Oklahoma Workforce Innovation Board from potential civil liability.

Authority for Investigation of Suspected Fraud

Members of the Central Oklahoma Workforce Innovation Board Executive Committee will have:

1. Free and unrestricted access to all Central Oklahoma Workforce Innovation Board records and premises, whether owned or rented; and

2. The authority to examine, copy, and/or remove all or any portion of the contents of files, desks, cabinets, and other storage facilities on the premises without prior knowledge or consent of any individual who may use or have custody or any such items or facilities when it is within the scope of their investigations.

Reporting Procedures

Great care must be taken in the investigation of suspected improprieties or irregularities so as to avoid mistaken accusations or alerting suspected individuals that an investigation is under way.

An employee who discovers or suspects fraudulent activity will contact the Chief Executive Officer or the Chair of the Board immediately. All inquiries concerning the activity under investigation from the suspected individual(s), his or her attorney or representative(s), or any other inquirer should be directed to the Executive Committee or legal counsel. No information concerning the status of an investigation will be given out. The proper response to any inquiry is “I am not at liberty to discuss this matter.” Under no circumstances should any reference be made to “the allegation”, “the crime”, “the fraud”, “the forgery”, “the misappropriation”, or any other specific reference.

The reporting individual should be informed of the following:

1. Do not contact the suspected individual in an effort to determine facts or demand restitution.

2. Do not discuss the case, facts, suspicions, or allegations with anyone unless specifically asked to do so by the Central Oklahoma Workforce Innovation Board. legal counsel or the Executive Committee.

Security

Accounting Department

A lock will be maintained on the door leading into the Central Oklahoma Workforce Innovation Board. This door shall be closed and locked in the evenings. The key/combination to this lock will be provided to all Central Oklahoma Workforce Innovation Board. personnel. The lock will be changed whenever any of these individuals leaves the employment and does not turn in their office key for the Central Oklahoma Workforce Innovation Board.

The Central Oklahoma Workforce Innovation Board corporate seals and blank check stock shall be stored within the Controller office in a locked file cabinet. The cabinet will be locked with a key. Access to this office shall be by keys in the possession of the Chief Executive Officer and Controller.

Access to Electronically Stored Accounting Data

It is the policy of Central Oklahoma Workforce Innovation Board to restrict access to accounting software and data. Only duly authorized accounting personnel with data input responsibilities and the CEO will be granted access to the server drive that contains the accounting software.

Accounting personnel are expected to keep their logins to the accounting software secret. Administration of access to the accounting software shall be performed by a responsible individual independent of programming functions. Each drive enables a user to gain access to only those software and data files necessary for each employee’s required duties.

Storage of Back-up Files

It is the policy of Central Oklahoma Workforce Innovation Board to maintain daily and weekly back-up copies of electronic data files off-site in a secure, fire-protected environment. Access to back-up files shall be limited to individuals authorized by the Chief Executive Officer.

General Office Security

During normal business hours, all visitors are required to check in. After hours, a security key/combination code is required for access to the offices of Central Oklahoma Workforce Innovation Board. Keys/combination codes are issued only to employees of Central Oklahoma Workforce Innovation Board.

Technology and Electronic Communications

Purpose and Scope

The purpose of this policy is to identify guidelines for the use of Central Oklahoma Workforce Innovation Board technologies and communications systems. This policy establishes a minimum standard that must be upheld and enforced by users of the Organization’s technologies and communications systems.

The term “user”, as used in these policies, refers to employees (whether full-time, part-time or limited-term), independent contractors, consultants, and any other user having authorized access to, and using any of, the Organization’s computers or electronic communications resources.

Computer and electronic communications resources include, but are not limited to, host computers, file servers, stand-alone computers, laptops, printers, fax machines, phones, on-line services, E-mail systems, bulletin board systems, and all software that is owned, licensed, or operated by Central Oklahoma Workforce Innovation Board.

Acceptable Use of Organization Property

Use of the Organization’s computers and electronic communications technologies is for programmatic and business activities of Central Oklahoma Workforce Innovation Board. All use of such resources shall be in an honest, ethical, and legal manner that conforms to applicable license agreements, contracts, and policies regarding their intended use.(see computer usage policy) Although incidental and occasional personal use of the Organization’s communications systems are permitted, users automatically waive any rights to privacy.

In addition, the information, ideas, concepts, and knowledge described, documented, or contained in the Organization’s electronic systems are the intellectual property of Central Oklahoma Workforce Innovation Board. The copying or use of the Organization’s intellectual property for personal use or benefit during or after employment (or period of contract) with Central Oklahoma Workforce Innovation Board is prohibited unless approved in advance by the Chief Executive Officer.

All hardware (laptops, computers, monitors, mice, keyboards, printers, telephones, fax machines, etc.) issued by Central Oklahoma Workforce Innovation Board. is the property of the Organization and should be treated as such. Users may not physically alter or attempt repairs on any hardware at any time. Users must report any problems with hardware to the CEO or COO.

Password Security

Users are responsible for safeguarding their login passwords. Passwords may not be shared, nor should they be printed or stored on-line. Users should not leave their computers unattended without logging off.

Confidentiality

All information about individuals, families or organizations served by Central Oklahoma Workforce Innovation Board is confidential. No information may be shared with any person or organization outside Central Oklahoma Workforce Innovation Board without the prior written approval of the individual, family or organization and the Chief Executive Officer.

Copyrighted Information

Use of Central Oklahoma Workforce Innovation Board electronic communication systems to copy, modify, or transmit documents, software, information or other materials protected by copyright, trademark, patent or trade secrecy laws, without obtaining prior written permission from the owner of such rights in such materials, is prohibited.

Installation of Software

The installation of new software on the computers of Central Oklahoma Workforce Innovation Board without the prior approval of the Chief Executive Officer, or his designee, is prohibited. If an employee desires to install any new programs onto a Central Oklahoma Workforce Innovation Board’s computer, written permission should first be obtained.

Other Prohibited Uses

Other prohibited uses of the Organization’s communication systems include, but are not limited to:

- Engaging in any communication that is discriminatory, defamatory, pornographic, obscene, racist, sexist or that evidences religious bias, or is otherwise of a derogatory nature toward any specific person, or toward any race, nationality, gender, marital status, sexual orientation, religion, disability, physical characteristic, or age group.

- Browsing or downloading and/or forwarding and/or printing pornographic, profane, discriminatory, threatening or otherwise offensive material from any source including, but not limited to, the Internet.

- Engaging in any communication that is in violation of Federal, state or local laws.

- Proselytizing or promoting any religious belief or tenet.

- Campaigning for or against any candidate for political office or any ballot proposal or issue.

- Sending, forwarding, redistributing or replying to “chain letters.”

- Unauthorized use of passwords to gain access to another user’s information or communications on Central Oklahoma Workforce Innovation Board systems or elsewhere.

- Advertising, solicitation or other commercial, non-programmatic use.

- Knowingly introducing a computer virus into the Organization’s communication system or otherwise knowingly causing damage to the Organization’s systems.

- Using the Organization’s systems in a manner that interferes with normal business functions in any way, including but not limited to, streaming audio from the Internet during business hours, stock tickers, installing unauthorized software, etc.

- Excessive personal use of the Organization’s technologies that preempts any business activity or interferes with Organizational productivity.

- Sending E-mail messages under an assumed name or obscuring the origin of an E-mail message sent or received.

Disciplinary Action for Violations

The Central Oklahoma Workforce Innovation Board requires all users to adhere to this policy. Violations of this policy will result in disciplinary action, which could include termination of employment or cancellation of contracts.

Reporting of Suspected Violations

Suspected violations of these policies should be immediately and confidentially reported to the Chief Executive Officer. If you prefer not to discuss it with the Chief Executive Officer, you may contact the Board Chairman.

Central Oklahoma Workforce Innovation Board reserves the right to install programs that monitor employee use of the Internet and electronic communication systems and to act on any violations of these policies found through use of such programs. Central Oklahoma Workforce Innovation Board further reserves the right to examine any and all electronic communications sent or received by employees via the Organization’s electronic communications systems.

General Ledger and Chart of Accounts

The general ledger is defined as a group of accounts that supports the information shown in the major financial statements. The general ledger is used to accumulate all financial transactions of Central Oklahoma Workforce Innovation Board, and is supported by subsidiary ledgers that provide details for certain accounts in the general ledger. The general ledger is the foundation for the accumulation of data and reports.

Chart of Accounts Overview

The chart of accounts is the framework for the general ledger system, and therefore, the basis for Central Oklahoma Workforce Innovation Board.’s accounting system. The chart of accounts consists of account titles and account numbers assigned to the titles. General ledger accounts are used to accumulate transactions and the impact of these transactions on each asset, liability, equity, revenue, expense and gain and loss account.

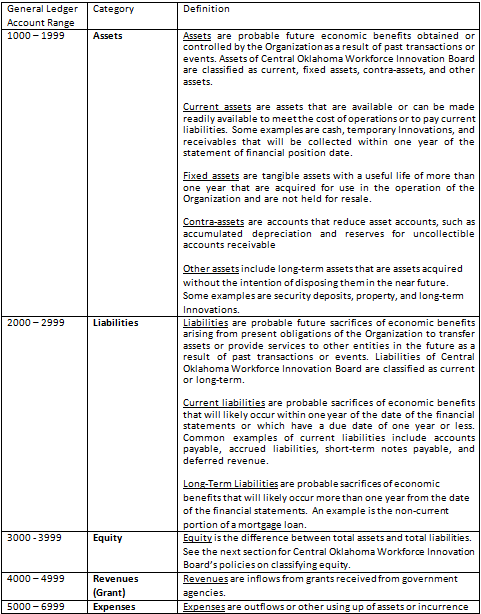

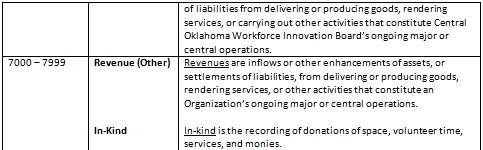

Central Oklahoma Workforce Innovation Board’s chart of accounts is comprised of six (6) types of accounts:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

- In-kind

Each 4-digit account code shall be followed by a two-digit contractor code and then by a two-digit fund code. An additional four code methodology to follow the above eight digits is being developed to coincide with reporting requirements.

Distribution of Chart of Accounts

All Central Oklahoma Workforce Innovation Board employees involved with account coding responsibilities (assignment or review of coding) or budgetary responsibilities will be issued a current chart of accounts. As the chart of accounts is revised, an updated copy of the chart of accounts shall be distributed to these individuals promptly.

Control of Chart of Accounts

Central Oklahoma Workforce Innovation Board’s chart of accounts is monitored and controlled by the Controller. Responsibilities include the handling of all account maintenance, such as additions and deletions. Any additions or deletions of accounts should be approved by the Controller, who ensures that the chart of accounts is consistent with the organizational structure of Central Oklahoma Workforce Innovation Board and meets the needs of each division and department.

Account Definitions

Classification of Equity

Equity of the Organization shall be classified based upon the existence or absence of donor-imposed restrictions as follows:

- Unrestricted Equity – Equity that is not subject to donor imposed stipulations.

- Temporarily Restricted Equity – Equity subject to donor imposed stipulations that may or will be satisfied through the actions of the Organization and/or the passage of time.

- Permanently Restricted Equity – Equity subject to donor-imposed stipulations that the Organization permanently maintain certain contributed equity. Generally, donors of such equity permit the Organization to use all or part of the income earned from permanently restricted equity for general operations or for specific purposes.

Changes to the Chart of Accounts

Additions to, deletions from, or any other changes to Central Oklahoma Workforce Innovation Board’s standard chart of accounts shall only be done with the approval of the Controller and Chief Executive Officer

Fiscal Year of Organization

Central Oklahoma Workforce Innovation Board shall operate on a fiscal year that begins on July 1st and ends on June 30th. Any changes to the fiscal year of the Organization must be ratified by majority vote of Central Oklahoma Workforce Innovation Board of Directors.

Journal Entries

All general ledger entries that do not originate from a subsidiary ledger shall be supported by a General Journal Voucher form (Appendix A), which shall include a reasonable explanation of each such entry. Examples of such journal entries include:

- Recording of non-cash transactions

- Corrections of posting errors

- Non-recurring accruals of income and expenses

The general journal form will be completed by the Controller. When the entries are completed they will be signed and dated by the operator. The Controller will maintain a file of completed general journal forms.

Policies Associated with Revenues and Cash Receipts

Revenue

Revenue Recognition Policies

Central Oklahoma Workforce Innovation Board receives revenue from several types of transactions. Revenue from each of these types of transactions is recognized in the financial statements of Central Oklahoma Workforce Innovation Board in the following manner:

- Grant Income – Monthly accrual based on incurrence of allowable costs (for cost-reimbursement awards) or based on other terms of the award (for fixed price, unit-of-service, and other types of awards)

- Contract Income – Monthly accrual based on incurrence of service/goods provided.

- Interest Income – Interest earned on bank accounts recorded as received.

- Assignments Income – Income entered to recognize grant obligations paid directly to a vendor by the funding source on behalf of the agency.

- In-Kind Income – Donations/contributions acquired and documented (see the next section on donations)

- Miscellaneous Income – Recognized as income when received.

Donations Received

Policies of certain funding sources require that various types of donations be acquired and documented. Such “in-kind” donations contribute to the overall effectiveness of our mission and in specific cases, are mandatory to meet Federal guidelines. Donations include space, volunteer time, services, and monies. It is the responsibility of each Program Manager to ensure that donation requirements are met, properly recorded and controlled. No type of donations will be utilized by employees for their personal use.

Donations of Space

All Agency facilities for which rent and/or utilities may not be paid qualify as donated space. The number of square feet donated will be included in the space contracts with the fair market rental price per square foot to be determined by the owner of the property or by criteria available to the Organization. Donated space amounts will be maintained on the books of the Organization by the Accounting Department.

In instances where rent is paid for space but at a rate lower than fair market rental price, the difference between the two rates may be counted toward in-kind requirements. Furnished utility costs may be documents with receipts from utility companies or landlords as in-kind services. This is documented by using the form in Appendix B.

Donations of Volunteer Time and Services

This form of “in-kind” must be documented monthly (Appendix B). Dollar amounts per hour for the donated time or service will be determined by the CEO according to the fair value of the service per hour. In the case of some special services, the amounts to be donated shall be included in a contract with documentation.

Upon certification of volunteer time, the Accounting Department will include the donated time in the books of the Organization.

Donations of Cash

All donations of cash require the issuance of a receipt. Cash donations will be routed to the Accounting Department for recording and deposit.

Billing/Invoicing Policies

Overview

The following is a list of items billed and/or accrued and received by Central Oklahoma Workforce Innovation Board and the frequency with which each is billed:

Monthly Billings

- Grants and contracts (See separate section on “Policies Associated with Federal Awards” for billing policies associated with Federal grant agreements)

- Other “as needed” billings

Responsibilities for Billing and Collection/Request for Funds

The Accounting Department will ensure that an adequate cash flow exists to meet our obligations. Each funding source has established requirements for requesting funds. Requests must be submitted on time. Amounts requested for the next period will be based on the projects cash requirements after recognizing the current cash balance, current liabilities, and the future period expected expenditures.

Accounts Receivable Entry Policies

Posting of customer invoices to the accounts receivable subsidiary ledger shall be performed by individuals independent of the cash receipts function of Central Oklahoma Workforce Innovation Board.

Posting of credit memos and other adjustments to customer accounts receivable shall also be performed by an individual independent of the cash receipts function of Central Oklahoma Workforce Innovation Board and approved by the Controller.

Classification of Income and Equity

All income received by Central Oklahoma Workforce Innovation Board is classified as “unrestricted”, with the exception of the following:

- Grants and other awards received from government agencies or other grantors, which are classified as temporarily restricted; and

- Special endowments received from donors requesting that these funds be restricted for specific purposes.

From time to time, Central Oklahoma Workforce Innovation Board may raise other forms of contribution income which carry stipulations that Central Oklahoma Workforce Innovation Board utilize the funds for a specific purpose or within a specified time period identified by the donor of the funds. When this form of contribution income is received, Central Oklahoma Workforce Innovation Board shall classify this income as Temporarily Restricted income.

As with all Temporarily Restricted equity, when the restriction associated with a contribution has been met (due to the passing of time or the use of the resource for the purpose designated by the donor), Central Oklahoma Workforce Innovation Board will reclassify the related equity from “Temporarily Restricted” to “Unrestricted” in its Statement of Financial Position and reflect this reclassification as an activity in its Statement of Activities.

Cash Receipts

Overview

Cash (including checks payable to the Organization) is the most liquid asset the Organization has. Therefore, it is the objective of Central Oklahoma Workforce Innovation Board to establish and follow the strongest possible internal controls in this area.

Processing of Checks and Cash Received in the Mail

For funds that are received at Central Oklahoma Workforce Innovation Board cash receipts are immediately forwarded to the Controller to ensure cash is recorded in the cash receipts log and deposited on a timely basis.

Mail is opened and a listing of cash/checks received shall be prepared in an open area, in the presence of other employees, and under the supervision of the Controller. The individual preparing the daily list of receipts shall be someone that is involved in the accounts receivable or accounts payable process.

The Controller will prepare and code the duplicate deposit slips from the cash/checks received and compare them to the daily receipts listing for discrepancies. Deposits are prepared and taken to the bank on a daily basis by an individual other than the employee who prepared the daily cash receipts listing.

The Controller will maintain a file of all recorded deposits.

The Controller will prepare a journal entry or cash receipt to record all direct deposits transactions.

Endorsement of Checks

It is the policy of Central Oklahoma Workforce Innovation Board that all checks received that are payable to the Organization shall immediately be restrictively endorsed by the individual who prepares the daily receipts listing. The restrictive endorsement shall be a rubber stamp that includes the following information:

- For Deposit Only

- Central Oklahoma Workforce Innovation Board

- The bank name

Timeliness of Bank Deposits

It is the policy of Central Oklahoma Workforce Innovation Board that bank deposits will be made on a daily basis.

Reconciliation of Deposits

On a periodic basis, the Controller who does not prepare the initial cash receipts listing or bank deposit, shall reconcile the listings of receipts to bank deposits reflected on the monthly bank statement. Any discrepancies shall be immediately investigated.

Note: This policy is intended as a supplement to, not a part of, the monthly bank reconciliation process. The intention is to establish an additional periodic reconciliation designed to identify any instances in which funds received and logged in were not deposited in a timely manner to the Organization’s bank accounts.

Receipts

Receipts must be issued for all incoming cash delivered to the Accounting Department.

Accounts Receivable Management

Monitor and Reconciliations

On a monthly basis, a detailed accounts receivable report (showing aged, outstanding invoices by customer) is generated and reconciled to the general ledger by the accounting department. All differences are immediately investigated and resolved, and the Controller reviews the reconciliation.

Collections

Collections are performed on a monthly basis, according to a review of the outstanding items shown on the accounts receivable aging report. This report shows the current month’s activity for each customer and prior months’ balances outstanding for 30, 60, 90, and 120 days.

Credits and Other Adjustments to Accounts Receivable

From time to time, credits against accounts receivable from transactions other than payments and bad debts will occur. Examples of other credits include write offs, denials and adjustments for billing errors. All credits shall be processed by an employee who is independent of the cash receipts function. In addition, all credits shall be authorized by the Controller.

Accounts Receivable Write-Offs Authorization Procedures

It is the policy of Central Oklahoma Workforce Innovation Board to ensure that all available means of collecting accounts receivable have been exhausted before write-off procedures are initiated. If an account receivable is deemed uncollectible, the Chief Executive Officer must approve before the write-off is processed.

If write-off procedures have been initiated, the following accounting treatment applies:

- Current year invoices that are written off will either be charged against an appropriate revenue or revenue adjustment account or against the original account credited.

- Invoices written off that are dated prior to the current year will be treated as bad debt and will reduce the allowance for doubtful accounts, discussed in the next section.

Reserve for Uncollectible Accounts

It is the policy of Central Oklahoma Workforce Innovation Board. to maintain a reserve for uncollectible accounts receivable. At the end of each fiscal year, the allowance for doubtful accounts is adjusted based on the following factors:

- An analysis of outstanding aged accounts receivable

- Historical collection and bad debt experience

- Evaluations of specific accounts based on discussions with the department that originated the sale/service resulting in the receivable

Year-end adjustments to the reserve for uncollectible accounts shall be performed only with authorization and by the Controller.

This reserve account is used in the following year to write off those items that are deemed uncollectible from the prior year after further collection efforts have been abandoned, as described earlier.

Policies Associated with Expenditures and Disbursements

Purchasing Policies and Procedures

Overview

THE POLICIES DESCRIBED IN THIS SECTION APPLY TO ALL PURCHASES MADE BY CENTRAL OKLAHOMA WORKFORCE INNOVATION BOARD.

ADDITIONAL POLICIES APPLICABLE ONLY TO THOSE PURCHASES MADE UNDER FEDERAL AWARDS ARE DESCRIBED IN THE SECTION “POLICIES ASSOCIATED WITH FEDERAL AWARDS.”

It is the policy of Central Oklahoma Workforce Innovation Board to follow a practice of ethical, responsible, and reasonable procedures related to purchasing, agreements and contracts, and related forms of commitment. The policies in this section describe the principles and procedures that all staff shall adhere to in the completion of their designated responsibilities.

Responsibility for Purchasing

The Chief Executive Officer authorizes all purchases.

Non-Discrimination Policy

All vendors/contractors who are the recipients of Organization funds, or who propose to perform any work or furnish any goods under agreements with Central Oklahoma Workforce Innovation Board shall agree to these important principles:

- Vendors/Contractors will not discriminate against any employee or applicant for employment because of race, religion, color, sexual orientation or national origin, except where religion, sex, or national origin is a bona fide occupational qualification reasonably necessary to the normal operation of the vendors/contractors.

- Vendors/contractors agree to post in conspicuous places, available to employees and applicants for employment, notices setting forth the provisions of this non-discrimination clause. Notices, advertisement, and solicitations placed in accordance with Federal law, rule, or regulation shall be deemed sufficient for meeting the intent of this section.

Purchases and Invoices

The Accounting Department will not pay an obligation until the original invoice has been received and approved by the CEO. Invoices may be mailed directly to the Accounting Department by the vendor or hand carried by the purchaser directly to the Accounting Department. No financial obligation will be paid without an original invoice approved by the Chief Executive Officer.

Miscellaneous Reimbursement

To be reimbursed for an approved purchase, the employee must fully complete a Reimbursement Request/Voucher Form (Appendix D), attach a dated receipt of purchase, obtain the Chief Executive Officer signature, and submit the reimbursement form to the Accounting Department. A reimbursement check will be issued to the employees within ten (10) working days after receipt of the form.

Payment of Contracts

All contracts/agreements are processed by the accounting department and signed by Chief Executive Officer. The accounting section will not affect contractual payments unless an approved contract signed by the Chief Executive Officer is on file. The original signed contract will be maintained on file by the Accounting Department. Before payment, the individual monitoring the contract will, in writing, verify that the work or service has been completed according to the terms of the contract. After submission to the Accounting Department, payment to the contractor will be effected in accordance with the terms of the contract.

Ongoing contracts such as utility payments or contracts space will automatically be paid by the Accounting Department upon such receipt of a valid contract and continue until contract termination or amendment.

Procedures

All employees

- Purchase Requisitions: All employees requiring supplies to be purchased shall submit a purchase requisition to the Chief Executive Officer for review and approval to ensure viability and programmatic integrity. The purchase requisition will specify:

- item to be purchased

- vendor

- probable price

- Purchasing: The Policy Analyst and/or CEO will verify the purchase follows grantor directives in obtaining best value before placing order. In addition to price, staff may also consider transportation costs, quality, and delivery time in determining supplier.

- Receipt of Goods or Services: On receipt of the shipment or delivery of service, the receiving employee will sign a receiving copy. All disbursements will be made according to the disbursement procedures. The Accounting Department will maintain the original purchase documents on file.

Other Purchasing Requirements

- Contracts: A contract, letter, or memo authorizing the contract shall be on file. No receiving report for contract is necessary. As evidence of receipt of services, the invoice must be presented to the official responsible for the contract and signed by him/her. The invoice is then given to the Accounting Department who refers to the contract, letter, or memo number when making payment.

- Services of Continuing Nature: In the case of services of a continuing nature, a copy of agreement or contract should be on file. All requests for payment will be verified by an examination of the contract.

- Procurement Records: The procurement records of purchases in excess of the small purchase threshold will include the following information:

- All solicitation efforts. This can include newspaper clippings, advertisements, or postings. (postings must include date and location.)

- A copy of the specifications and evaluation criteria

- A cost or price analysis, basis for selection, or contractor or vendor.

- Sole Source Procedures: All sole source procurement must be approved in advance and in writing by the Chief Executive Officer and funding source if required. The written request to utilize sole source procurement must include a description of the goods or services be purchased and justification for the sole source procurement.

- Contracts and Contractor Administration: After a contract has been approved, the Controller and Policy Analyst will receive a copy of the terms, conditions and specifications, the contract, or purchase quarterly. The Policy Analyst will evaluate contractor or vendor performance based on the contract terms, conditions, and specifications. This evaluation will be in writing and made a part of the contract files. A copy of this evaluation will be sent to the Chief Executive Officer.

Payment Authorization

Payment Authorization is given by the Chief Executive Officer when original invoices have been received from the vendors with appropriate documentation. Check register will be given to the Chief Executive Officer for final approval. All checks require one signature. Check numbers will be logged on the journal for accountability. All checks are pre-numbered and must be accounted for. After checks are mailed, payment vouchers (if any) and invoices will be stamped paid indicating that payment has been made. This same procedure will be used for contract payments and miscellaneous expense reimbursements.

Affirmative Consideration of Minority, Small Business and Women Owned Businesses

Positive efforts shall be made by Central Oklahoma Workforce Innovation Board. to utilize small businesses, minority-owned firms, and women’s business enterprises, whenever possible. The following steps shall be taken in furtherance of this goal:

- Ensure that small business, minority-owned firms, and women’s business enterprises are used to the fullest extent practicable.

- Make information on forthcoming opportunities available and arrange time frames for purchases and contracts to encourage and facilitate participation by small business, minority-owned firms, and women’s business enterprises.

- Consider in the contract process whether firms competing for larger contracts tend to subcontract with small businesses, minority-owned firms, and women’s business enterprises.

- Encourage contracting with consortiums of small businesses, minority owned firms and women’s business enterprises when a contract is too large for one of these firms to handle individually.

- Use the services and assistance, as appropriate, of such organizations as the Small Business Administration and the Department of Commerce’s Minority Business Development Agency in the minority-owned firms and women’s business enterprises.

Procurement Standards

Before expenditures are made in which Federal and state funds are used, they must first be examined to determine if the costs are allowable, reasonable, and allocable to the award. This can be done using Uniform Administrative Requirements at 2 CFR Part 200, General Principals as a guide.

The procurement of supplies, equipment, construction, and services shall be obtained in an efficient and economical manner and shall be in compliance with the provisions of applicable Federal and State law, Executive Orders and policy guidance from the Oklahoma Office of Workforce Development.

- Code of Conduct: No Central Oklahoma Workforce Innovation Board employee, officer, or agent shall participate in the selection, award, of administration of a contract supported by Federal, State or local funds if a conflict of interest, real or apparent, would be involved. This would include a Central Oklahoma Workforce Innovation Board employee, officer or agent, any member of their family, or partner having a financial or other interest in the firm selected for award. Central Oklahoma Workforce Innovation Board officers or employees, or agents shall neither solicit nor accept gratuities, favors, or anything of monetary value from contractors, as pertains to agency Personnel Policies, and sanctions or penalties for officers, agents, or contractors will be determined, by occurrence, by the Central Oklahoma Workforce Innovation Board and permitted by State or local law regulations.

- Procurement Policy: Central Oklahoma Workforce Innovation Board will adhere to the Oklahoma Office of Workforce Development’s procurement policies and procedures, as well as those published by the U.S. Department of Labor and the Uniform Administrative Requirements.

Vendor Files and Required Documentation

The Accounting Department shall create a vendor file for each new vendor from whom Central Oklahoma Workforce Innovation Board purchases goods or services.

Central Oklahoma Workforce Innovation Board shall obtain a completed Form W-9 or equivalent substitute documentation from all vendors to whom payments are made. A record shall be maintained of all vendors to whom a Form 1099 is required to be issued at year-end. Payments to such vendors shall be accumulated over the course of a calendar year.

See the section on “Payroll and Related Policies” for guidance on determining whether a vendor should be treated as an employee.

Ethical Conduct in Purchasing

Ethical conduct in managing the Organization’s purchasing activities is an absolute essential. Staff must always be mindful that they represent the Board and share a professional trust with other staff and the general membership.

Staff shall discourage the offer of, and decline, individual gifts or gratuities of value in any way that might influence the purchase of supplies, equipment, and/or services. Staff shall notify the Chief Executive Officer if they are offered such gifts.

Conflicts of Interest Prohibited

No officer, board member, employee, or agent of Central Oklahoma Workforce Innovation Board. shall participate in the selection or administration of a vendor if a real or apparent conflict of interest would be involved. Such a conflict would arise if an officer, board member, employee or agent, or any member of his/her immediate family, his/her spouse/partner, or an organization that employs or is about to employ any of the parties indicated herein, has a financial or other interest in the vendor selected.

Officers, board members, employees, and agents of Central Oklahoma Workforce Innovation Board shall neither solicit nor accept gratuities, favors, or anything of monetary value from vendors or parties to sub-agreements. All Board Members and Staff are required to sign a conflict of interest form. (see Personnel Policy)

Receipt and Acceptance of Goods

A designated individual shall inspect all goods received. Upon receipt of any item from a vendor, the following actions shall immediately be taken:

- Review bill of lading for correct delivery point

- Verify the quantity of boxes/containers with the bill of lading

- Examine boxes/containers for exterior damage

- Note on the bill of lading any discrepancies (missing or damaged boxes/containers, etc.)

- Sign and date the bill of lading

- Retain a copy of the bill of lading

It is the policy of Central Oklahoma Workforce Innovation Board to perform the preceding inspection procedures in a timely manner in order to facilitate prompt return of goods and/or communication with vendors.

Political Intervention

Prohibited Expenditures

Consistent with its tax-exempt status under the Internal Revenue Code, it is the policy of Central Oklahoma Workforce Innovation Board that the Organization shall not incur any expenditure for political intervention. For purposes of this policy, political intervention shall be defined as any activity associated with the direct or indirect support or opposition of a candidate for elective public office at the Federal, state or local level. Political intervention does not include lobbying activities, defined as the direct or indirect support or opposition for legislation, which is not prohibited under the Internal Revenue Code for Central Oklahoma Workforce Innovation Board Examples of prohibited political expenditures include, but are not limited to, the following:

- Contributions to political action committees

- Contributions to the campaigns of individual candidates for public office

- Contributions to political parties

- Expenditures to produce printed materials (including materials included in periodicals) that support or oppose candidates for public office

- Expenditures for the placement of political advertisements in periodicals

Endorsement of Candidates

It is the policy of Central Oklahoma Workforce Innovation Board not to endorse any candidates for public office in any manner, either verbally or in writing. This policy extends to the actions of management and other representatives of Central Oklahoma Workforce Innovation Board, when these individuals are acting on behalf of, or are otherwise representing, the Organization.

Prohibited Use of Organization Assets and Resources

It is the policy of Central Oklahoma Workforce Innovation Board that no assets or human resources of the Organization shall be utilized for political activities, as defined above. This prohibition extends to the use of Organization assets or human resources in support of political activities that are engaged in personally by board members, members of management, employees, or any other representatives of Central Oklahoma Workforce Innovation Board. While there is no prohibition against these individuals engaging in political activities personally (on their own time and without representing that they are acting on behalf of the Organization), these individuals must at all times be aware that Organization resources cannot at any time be utilized in support of political activities.

Accounts Payable Management

Overview

The Central Oklahoma Workforce Innovation Board strives to maintain efficient business practices and good cost control. A well-managed accounts payable function can assist in accomplishing this goal from the purchasing decision through payment and check reconciliation.

It is the policy of Central Oklahoma Workforce Innovation Board that an employee independent of ordering and receiving performs the recording of assets or expenses and the related liability. The amounts recorded are based on the vendor invoice for the related goods or services. The vendor invoice should be reviewed and approved by the Chief Executive Officer prior to being processed for payment. Invoices and related general ledger account distribution codes are reviewed prior to posting to the subsidiary system.

The primary objective for accounts payable and cash disbursements is to ensure that:

- Disbursements are properly authorized

- Invoices are processed in a timely manner

- Vendor credit terms and operating cash are managed for maximum benefits

Recording of Accounts Payable

All valid accounts payable transactions, properly supported with the required documentation, shall be recorded as accounts payable in a timely manner.

Accounts payable are processed on a daily basis. Information is entered into the system from approved invoices or disbursement vouchers with appropriate documentation attached.

It is the policy of Central Oklahoma Workforce Innovation Board that only original invoices will be processed for payment unless duplicated copies have been verified as unpaid by researching the vendor records. No vendor statements shall be processed for payment.

Preparation of a Voucher

Prior to any account payable being submitted for payment, a payment voucher form/invoice, plus documentation shall be assembled. Each voucher package shall contain the following documents:

- Vendor invoice (or employee expense report)

- Packing slip (where appropriate)

- Receiving report (or other indication of receipt of merchandise and authorization of acceptance)

- Payment Voucher (if one was prepared prior to receipt of invoice)

- Any other supporting documentation deemed appropriate

Processing of Voucher

The following procedures shall be applied to each voucher and voucher documentation by the Controller:

- Check the mathematical accuracy of the vendor invoice.

- Compare the nature, quantity, and prices of all items ordered per the vendor invoice to the packing slip and receiving report.

- Document the general ledger distribution, using the Organization’s current chart of accounts.

- Obtain the review and approval of the Chief Executive Officer (or their designee) associated with the goods or services purchased.

Approvals by Chief Executive Officer indicate their acknowledgement of satisfactory receipt of the goods or services invoiced, agreement with all terms appearing on the vendor invoice, agreement with general ledger account coding, and agreement to pay vendor in full. Approvals shall be documented with initials or signatures of the approving individual.

Payment Discounts

To the extent practical, it is the policy of Central Oklahoma Workforce Innovation Board to take advantage of all prompt payment discounts offered by vendors. When availability of such discounts is noted, and all required documentation in support of payment is available, payments will be scheduled so as to take full advantage of the discounts.

Employee Expense Reports

Reimbursements for travel expenses and other approved costs will be made only upon the receipt of a properly approved and completed expense reimbursement form (see further policies under “Travel and Business Expense”). All receipts must be attached, and a brief description of the business purpose of the trip or meeting must be noted on the form.

Reconciliation of Accounts Payable Subsidiary Ledger to General Ledger

At the end of each monthly accounting period, the total amount due to vendors per the accounts payable unpaid a/p vouchers file shall be reconciled to the total per the accounts payable general ledger account. All differences are investigated and adjustments made as necessary.

The reconciliation and the results of the investigation of differences are reviewed and approved by the Controller.

Also on a monthly basis, the Controller shall check all statements received for unprocessed invoices.

Travel and Business Expense

General

Travel policies of the Agency will be strictly adhered to. All required documentation must be submitted prior to payment. Local travel is approved by the Chief Executive Officer. Out-of-area travel is defined as travel outside the service area, but within the state and must be approved in advance by the Chief Executive Officer. Out-of-state travel must be approved by the Chair and/or Chief Executive Officer.

Local Travel and Out-of-Area Travel

Employees will be reimbursed for local travel at the rate approved by the funding source. All local mileage must be authorized and approved by the Chief Executive Officer. Mileage will be documented daily and submitted monthly with the Local Travel Expense Form (Appendix E). Reasonable parking fees will be reimbursed only when necessary to the mission of the Agency. Mileage documentation will be submitted to the Accounting Department signed by the employee and approved by the Chief Executive Officer no later than the 10th day of the month. Late claims will not be processed until the following pay cycle.

Mileage will not be paid from an employee’s home to his/her work site. It is the responsibility of each employee to arrive at the work site by his/her own means. In the case of required work or meetings after regular hours, the Agency will pay mileage from the employee’s regular work site to the meeting place; or, if the employee’s residence is closer to the meeting site than to the work site, the Agency will pay mileage for the Lesser of the two distances. (see travel policy for exceptions connected to travel outside normal work times) At no time will the Agency compensate an employee for mileage used while on personal business; i.e. lunch, personal errands, etc.

- Employees must update and record travel on the Local Travel Expense form.

- Travel vouchers must be approved by the Chief Executive Officer or by the Board Chair and submitted to the accounting office on a monthly basis.

- Reimbursement will be on a set mileage rate as approved by the IRS. The travel voucher must be completely filled out and the required receipts attached.

- Travel vouchers are due in the accounting office by the 10th of the month. Incomplete travel vouchers will be returned to the employee and processed at a later date.

- All travel vouchers will be reviewed and approved to pay by the Chief Executive Officer. The CEO’s travel claim will be approved by the Board Chair

- Checks for all travel will be prepared in accordance with the check disbursement procedures.

Out-of-State Travel

Due to various funding sources, travel policies will differ. The source of funds under which each program operates will determine which out-of-town travel policy is to be followed.

The CEO must approve all out-of-state travel in advance. Upon return, each traveling employee must complete the Request and Authorization of Travel form (Appendix F) using actual travel, lodging, and per diem costs. The Board Chair will approve the CEO’s out-of-state travel.

Lodging receipts and mileage travel forms, if appropriate, are required documentation and must be attached to the Travel Claim. Travel arrangements, i.e. plane, bus, train reservations, etc., will be coordinated with the Chief Executive Officer.

- All out of area travel must be approved by the Chief Executive Officer.

- Employees must submit to the Chief Executive Officer the dates, destination, length of travel status, method of transportation, and purpose of travel for approval.

- Request for travel advances must be submitted to the Chief Executive Officer for approval.

- Travel advance checks will be prepared according to the check disbursement procedures. All travel advances will be recorded as a receivable.

- When the employee submits the travel voucher for payment the Controller will be responsible for reconciling the travel voucher and the travel advance. The Controller will approve any payment and will prepare the appropriate entries to the receivable account.

Cash Disbursements (check writing) Policies

Check Preparation

It is the policy of Central Oklahoma Workforce Innovation Board to print vendor checks and expense reimbursement checks at least on a weekly basis. Occasionally checks may have to be written more frequently to avoid late fees. Persons independent of those who initiate or approve expenditures, as well as those who are authorized check signers, shall prepare checks.

All vendor and expense reimbursement checks shall be produced in accordance with the following guidelines:

- All cash disbursements will be made from an approved payment voucher, which includes all the appropriate documentation. Documentation must include original invoice.

- All approved payment vouchers will be forwarded to the Accounts Payable. The Accounts Payable will enter the payment into the payable system.

- The Controller or Chief Executive Officer will be responsible for assigning payment priority to all payment vouchers and approving payment vouchers for payment. Before assigning payment priority, accounts must be verified for sufficient cash balances.

- The checks for payment of vouchers will be signed by the Chief Executive Officer or the Chairperson.

- All accounts payable check registers, upon completion of the payment process will be submitted for signature by the Chief Executive Officer. It will be the responsibility of the Controller to maintain the signed accounts payable batch reports.

- The Controller will be responsible for keeping all blank checks under lock and key.

- Expenditures must be supported in conformity with the purchasing, accounts payable, and travel and business expense policies described in this manual.

- Timing of disbursements should generally be made to take advantage of all early-payment discounts offered by vendors and to reduce the chance of late fees.

- Total cash requirements associated with each check run is monitored in conjunction with available cash balance in bank prior to the release of any checks.

- Checks shall be utilized in numerical order (unused checks are stored in a locked area in the Controller office)

- Checks shall never be made payable to “bearer” or “cash”.

- Checks shall never be signed prior to being prepared.

- Upon the preparation of a check, vendor invoices and other supporting documentation shall immediately be canceled in order to prevent subsequent reuse.

Mailing of Checks

After printing, checks are mailed immediately. Individuals who authorize expenditures shall not mail checks.

Voided Checks and Stop Payments

Checks may be voided due to processing errors by making proper notations in the check register and defacing the check by clearly marking it as “VOID”. All voided checks shall be retained to aid in preparation of bank reconciliations.

Stop payment orders may be made for checks lost in the mail or other valid reasons. Stop payments are processed by telephone instruction and written authorization to the bank by accounting personnel with this authority. A journal entry is made to record the stop payment and any related bank fees.

Payroll and Related Policies

Payroll actions will be effected in accordance with Personnel Policies and other Agency policies. All payroll policies and procedures will be administered, recorded, and documented in accordance with general acceptable accounting principles and Federal wage and hour guidelines.

Classification of Workers as Independent Contractors or Employees

It is the policy of Central Oklahoma Workforce Innovation Board. to consider all relevant facts and circumstances regarding the relationship between Central Oklahoma Workforce Innovation Board and the individual in making determinations about the classification of workers as independent contractors or employees. This determination is based on the degree of control and independence associated with the relationship between Central Oklahoma Workforce Innovation Board and the individual. Facts that provide evidence of the degree of control and independence fall into three categories:

- Behavioral control

- Financial control

- The type of relationship of the parties

Facts associated with each of these categories that will be considered by Central Oklahoma Workforce Innovation Board in making employee/contractor determinations shall include:

- Behavioral Control:

- Instructions given by Central Oklahoma Workforce Innovation Board to the worker that indicate control over the worker (suggesting an employee relationship), such as:

- When and where to work

- What tools or equipment to use

- What workers to hire or to assist with the work

- Where to purchase supplies and services

- What work must be performed by a specified individual

- What order or sequence to follow

- Training provided by Central Oklahoma Workforce Innovation Board to the worker (i.e. employees typically are trained by their employer, whereas contractors typically provide their own training)

- Instructions given by Central Oklahoma Workforce Innovation Board to the worker that indicate control over the worker (suggesting an employee relationship), such as:

- Financial Control

- The extent to which the worker has unreimbursed business expenses (i.e. employees are more likely to be fully reimbursed for their expenses than is a contractor)

- The extent of the worker’s Innovation in the facilities/assets used in performing services for Central Oklahoma Workforce Innovation Board (greater Innovation associated with contractors)

- The extent to which the worker makes services available to the relevant market

- How Central Oklahoma Workforce Innovation Board. pays the worker (i.e. guaranteed regular wage for employees vs. flat fee paid to some contractors)

- The extent to which the worker can realize a profit or loss.

- Type of Relationship:

- Written contracts describing the relationship that Central Oklahoma Workforce Innovation Board. and the individual intend to create

- Whether Central Oklahoma Workforce Innovation Board provides the worker with employee-type benefits, such as insurance, paid leave, etc.

- The permanency of the relationship

- The extent to which services performed by the worker is a key aspect of the regular business of Central Oklahoma Workforce Innovation Board.

If an individual qualifies for independent contractor status, the individual will be sent a Form 1099 if total compensation paid to that individual for any calendar year, on the cash basis, is $600 or more. The amount reported on a Form 1099 is equal to the compensation paid to that person during a calendar year (on the cash basis). Excluded from “compensation” are reimbursements of business expenses that have been accounted for by the contractor by supplying receipts and business explanations.

If an individual qualifies as an employee, a personnel file will be created for that individual and all documentation required by the Central Oklahoma Workforce Innovation Board. personnel policies shall be obtained. The policies described in the remainder of this section shall apply to all workers classified as employees.

Payroll Administration

Central Oklahoma Workforce Innovation Board operates on a bi-weekly payroll. For all Central Oklahoma Workforce Innovation Board employees, a personnel file is established and maintained with current documentation, as described throughout this section and more fully described in Central Oklahoma Workforce Innovation Board’s Personnel Policy.

The following forms, documents, and information shall be obtained and included in the personnel files of all new employees and be maintained by the Controller or Chief Executive Officer or Chief Operations Officer:

- Central Oklahoma Workforce Innovation Board employment application (and resume, if applicable)

2. Form W-4 Employee Federal Withholding Certificate

3. Form I-9 Employment Eligibility Verification

4. Job title and description and starting salary

5. Employee Agreement (if applicable)

6. Confidentiality Statement

7. New Employment Orientation

8. Payroll Status Change

9. Background Authorization

10. Applicant references (work & personal, if applicable)

11. Interview questions and notes

12. Form OK State Withholding Certificate

13. Copy of driver’s license

14. Copy of Social Security card issued by the Social Security Administration

15. Starting date and PT/FT

For employees without a current, valid driver’s license, acceptable alternative documents shall include:

1. U.S. Passport

2. Certificate of U.S. Citizenship (INS Form N-560 or N-561)

3. Voter’s registration card

4. U.S. Military card

5. ID card issued by a Federal, state or local government, provided it contains a photo

6. School record or report card (for persons under age 18 only)

For employees without a Social Security card, acceptable alternative documents shall include:

1. U.S. Passport

2. Certificate of U.S. Citizenship (INS Form N-560 or N-561)

3. Original or certified copy of a birth certificate issued by a state, county or municipal authority

4. Certificate of Birth Abroad issued by the Department of State (Form FS-545 or Form DS-1350)

5. U.S. Citizen ID Card (INS Form I-197)

6. Native American tribal document

7. ID Card for use of Resident Citizen in the United States (INS Form I-179)

Each employee payroll file shall also indicate whether the employee is exempt or non-exempt from the provisions of the Fair Labor Standards Act.

New Employees

- The Controller will be responsible for seeing that all new employees complete the following items:

- Central Oklahoma Workforce Innovation Board employment application

- Form I-9

- Form W-4

- Employee benefits application forms

- Oklahoma New Hire Reporting Form

- An employee hiring is not effective until all the forms listed above are completed.

- The Chief Executive Officer will complete a personnel action form for the new employee and submit it to the Controller.

Changes in Payroll Data

The executive assistant should be notified of all changes that affect payroll by completing a Personnel Action Form (see Appendix G). Changes would include a change in salary, hourly rate, withholding tax deductions, or a change in position.

- A personnel action form will be completed by the Chief Executive Officer on all personnel changes and will be forwarded to the Controller.

- After receiving notice of a termination, the Chief Executive Officer will generate a Separation from Employment form (Appendix H). This form will be forwarded and finalized by the Controller.

Lost or Misplaced Payroll Checks

Lost or Misplaced payroll checks should be reported to the payroll department as soon as possible. Upon verification that a lost/misplaced check has not cleared the bank, the employee will be asked to write a letter to document what has occurred.

Garnishments

Employees are expected to meet their obligations. The Controller must abide by the directions of the court in deducting earned income. Such amount is sent to the place designated by the court. A copy of the garnishment order will be forwarded to the employee.

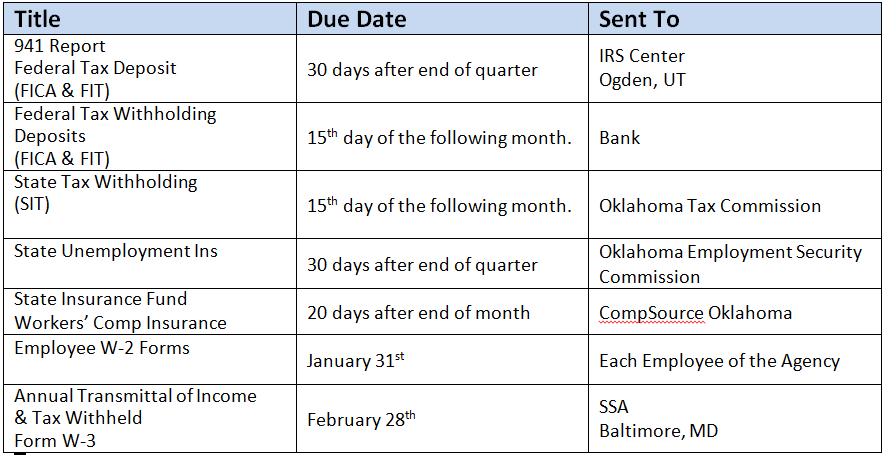

Payroll Taxes

The Controller in conjunction with the Accounting Assistant is responsible for ensuring all required tax forms and other required reports are properly completed and submitted, and that all required taxes are withheld and paid. Reports required are:

The Controller will be responsible for preparing all checks and entering journal entries for payroll taxes and benefits.

Leave

A record of leave earned/used is to be maintained by the Executive Assistant. Accrued leave information is available by the Accounting Department to determine the amount of leave accrued. Inquiries concerning possible errors will be directed to the Executive Assistant