How Can We Help?

COWIB Fraud Risk Assessment Policy & Procedures

Purpose

This Guide provides policy, guidance and procedures to ensure programmatic and financial accountability for the Workforce Innovation and Opportunity Act (WIOA) of 2014 Title I funds allocated for the Adult, Dislocated Worker, Business Services and Youth programs by thorough and comprehensive fraud risk assessment. This guide explains how to strategically manage risk, how to take risks to enlightened ways that enable the Central Oklahoma Workforce Innovation Board (COWIB) to fulfill its’ mission to the utmost. It is the intention of COWIB administration that this document conform to the pertinent legislation, regulation, state issued polices, and the Board’s intent to provide quality customer services.

The purpose of Workforce Innovation and Opportunity Act (WIOA) risk assessment and management is to:

- Ensure the integrity of the WIOA system and WIOA funds;

- Assess compliance with applicable laws and regulations; and

- Identify successful methods and practices that serve to enhance the system as a whole.

COWIB intends to meet these goals through continuous improvement by eliminating to the levels possible, any semblance of fraud and abuse of WIOA funds.

Authority

This Fraud Risk Assessment Guide is developed and implemented under the authority of the Workforce Innovation and Opportunity Act, Code of Federal Regulations, Title 2 section 200 (Uniform Administrative Requirements), and to satisfy the requirements covered by the Statement on Auditing Standards #99 (SAS 99).

Background

Risk management is a process for planning, organizing, directing and controlling the assets and activities of COWIB so that it can accomplish its’ mission by safeguarding against losses. The risk management process greatly minimizes the threat of loss by putting safeguards in place that will quickly identify areas of vulnerability and initiate internal control measures that will eliminate the threat.

Risk management is based on the premise that surprises must be anticipated, and preparations must be made, in order to turn aside or overcome the threats of bad surprises. COWIB, through risk management, will seek to maintain and enhance the confidence of its customers (i.e., employees, WIB Members, contractors, service participants, and stakeholders).

The COWIB maintains an Accounting and Financial Policies and Procedures Manual which includes a “Fraud Policy.” The COWIB’s Fraud Policy states:

Management is responsible for the detection and prevention of fraud, misappropriations, and other irregularities. Fraud is defined as the intentional, false representation or concealment of a material fact, or the intentional perversion of truth in order to induce another to part with something of value. Each member of the management team will be familiar with the types of improprieties that might occur within his or her area of responsibility, and be alert for any indication of irregularity.

Any fraud that is detected or suspected must be reported immediately to the Chief Executive Officer, Controller or, alternatively, to the Chair of the Central Oklahoma Workforce Innovation Board or to the Chief Local Elected Official. At that point an investigation into the allegation will begin.

State & Federal Requirements

In developing a policy and procedure for fraud risk assessment, the Central Oklahoma Workforce Innovation Board must be mindful of the requirements of our State and Federal funding sources.

Federal Policy

The primary funding source for risk assessment activities is the Workforce Innovation and Opportunity Act of 2014 (P.L. 113-128). The Act and the WIA Final Rule (20 CFR Part 603, Parts 651 through 658, Part 675 and Parts 679 through 688) give regulatory guidance to the local board in regards to oversight and monitoring. Additionally, the Code of Federal Regulations, 2 CFR Part 200, provide guidance to non-profit organizations like the COWIB which receive U.S. Department of Labor grant funds.

The federal regulations at 20 CFR Part 679 describes the oversight and monitoring requirements that local workforce investment boards must comply with.

State Policy

As a standard condition of the award of WIOA grant funds to the COWIB, the Oklahoma Office of Workforce Development (OOWD) requires COWIB to:

“ …Be solely responsible to ensure that the use of monies received under this agreement complies with all federal, state and local statutes, regulations and other legal authority, all as modified from time to time, that affect the use of said monies.”

Additionally, the Governor’s Oversight and Monitoring Plan (OWDI #11-2017) includes specific instructions to local boards and fiscal agents on oversight and monitoring activities.

Local Policy

It shall be COWIB policy to strategically identify, assess, and manage potential fraud risks within the Agency in such a way as to enable COWIB to fulfill its mission to the utmost with a very minimal threat of misuse of allocated WIA dollars.

Fraud Risk assessment will be performed to mitigate any area of real or potential fraud and systems will be monitored to ensure controls are in place to prevent the occurrence of fraud.

Local Procedure

Actions Constituting Fraud

Fraud is defined as the intentional, false representation or concealment of a material fact or the intentional perversion of truth in order to induce another to part with something of value. The terms fraud, defalcation, misappropriation, and other fiscal irregularities refer to, but are not limited to:

- Any dishonest or fraudulent act

- Forgery or alteration of any document or account belonging to Central Oklahoma Workforce Investment Board, Inc.

- Forgery or alteration of a check, bank draft, or any other financial document

- Misappropriation of funds, securities, supplies, equipment, or other assets of Central Oklahoma Workforce Investment Board, Inc.

- Impropriety in the handling or reporting of money or financial transactions

- Disclosing confidential and proprietary information to outside parties

- Accepting or seeking anything of material value from contractors, vendors, or persons providing goods or services to Central Oklahoma Workforce Investment Board, Inc. Exception: gifts less than a material value.

- Destruction, removal or inappropriate use of records, furniture, fixtures, and equipment

- Any similar or related irregularity

If there is a question as to whether an action constitutes fraud, contact the Chief Executive Officer or the Chair of the Central Oklahoma Workforce Innovation Board for guidance.

Executive Committee Responsibility

The Executive Committee is responsible for direction and oversight regarding the overall financial management of Central Oklahoma Workforce Investment Board, Inc. The Executive Committee serves as the primary point of contact for any employee who suspects that fraud has been committed against the Organization or by one of its employees or board members.[1]

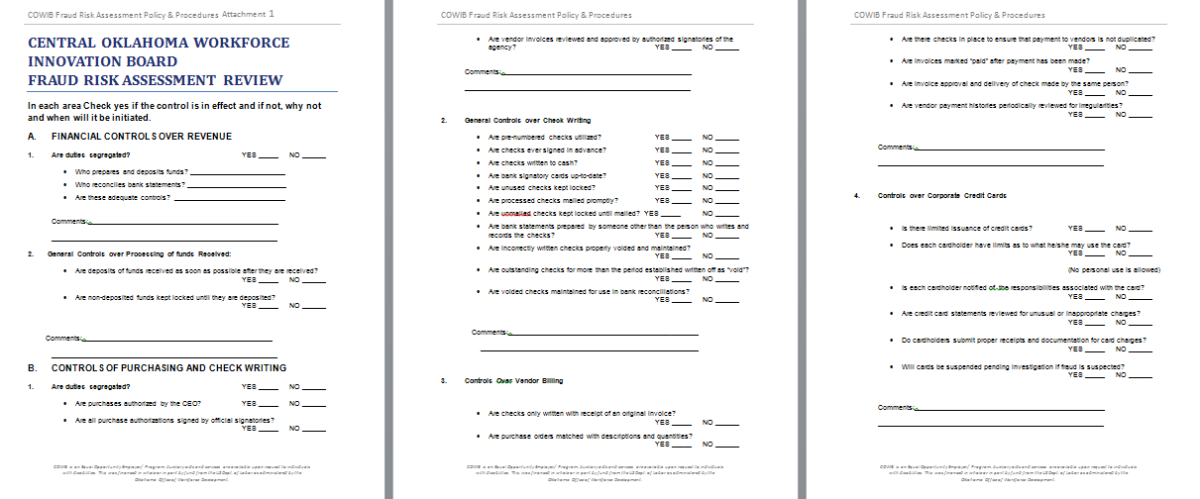

Fraud Risk Assessment Review

The COWIB’s Fraud Risk Assessment Review Form is given as an attachment to these procedures. Periodic reviews, using the attached form, will be completed according to a schedule to be determined by the Chief Executive Officer in consultation with the Executive Committee.

Persons conducting the risk assessment will have access to all plans, contracts, grants, sub grants, worksite agreements, records and files. The appropriate staff will be provided with all pertinent work papers, correspondence and reports. The staff will be placed on routing lists to receive copies of all federal, state and local regulations, issuances, policies, procedures and memos pertaining to WIA.

Risk assessment activities will be in accordance with federal, state and local regulations, policies and procedures and will be accountable to: (a) The Chief Executive Officer, and (b) The COWIB’s Executive Committee.

Any fraud that is detected or suspected must be reported according to the instructions given in the COWIB’s Accounting and Financial Procedures Policy and Procedures Manual.

Review Objectives

The objectives of the review are set in place in order to assist the reviewers in determining the effectiveness of COWIB’s Risk Assessment Process. Those Objectives are:

Objective 1

Determine the appropriate scope for the review by determining what have been previous areas of weakness by reviewing previous audit reports, monitoring reports, etc. Review management responses to previous reports and what steps were taken to resolve the issues.

Objective 2

Determine if the Board and Key Personnel properly enforce and adhere to the Risk Management Process in place and controls are being followed such as segregation of duties to the extent possible, identifying key positions and determining if back-up personnel are identified and in place, and succession plans to provide for an acceptable transition in the event of loss of a key employee.

Objective 3

Determine the adequacy of the Risk Assessment Process and management by ensuring that adequate controls are in place where vulnerability exists; and by maintaining a record of areas of vulnerability that must be identified and monitored on a regular basis.

Objective 4

Determine the extent of the Board involvement in the Risk Assessment Process and determine the process for reporting and resolving any problems encountered during the assessment process.

Once COWIB has identified the universe of risks, the COWIB’s CEO under the direction of the WIB will estimate probability of occurrence as well as the financial, reputation, or other impact to the organization.

Organizational impacts are highly variable and not always easy to quantify, but include such considerations as lost revenue, flawed business decisions, data recovery and recovery expense, costs such as litigation, and potential judgments.

The following are areas of high vulnerability and will be monitored on an ongoing basis to ensure adequate controls are in place and being followed:

- Financial Controls over Revenue

- Segregation of duties controls in place will include, to the extent possible

- Preparation of bank deposits – accounting personnel

- Making deposits to the bank accounts – personnel other than accounting

- Reconciling Bank Statements – reviewed by CEO

- General Controls Over Processing of Funds Received

- Deposit all funds received as soon as possible after they are received by other than accounting personnel

- Lock up any funds received that are not deposited by close of business day – may be performed by accounting.

- Segregation of duties controls in place will include, to the extent possible

- Controls of Purchasing and Check Writing

- Segregation of Duties to the extent possible

- Purchase requests should be signed by someone other than the person preparing the request.

- Purchase authorizations signed by authorized signatories of the agency

- Approval of vendor invoices signed by authorized signatories of the agency

- General Controls Over Check Writing

- Only pre-numbered checks will be utilized

- No checks will be signed in advance

- No checks will be written to cash

- Promptly update the bank’s listing of authorized signers when a check signer is no longer authorized due to retirement, resignation, termination, etc.

- Unused checks will be kept in a locked file.

- Mail all checks promptly after signature

- Lock up all checks not mailed out on the date signed

- Bank statements will be reconciled by the controller and reviewed by the CEO

- Checks that have been incorrectly written or will otherwise not be used will be properly voided

- Write off as “void” checks outstanding for more than the period established in COWIB Accounting Procedures

- A list of the “voided” checks as well as physical custody of the defaced checks will be maintained for use in preparation of bank reconciliations

- Controls Over Vendor Billing

- Checks will be processed only in connection with an original vendor invoice (no photocopies).

- Purchases will be matched with description and quantities

- Vendor invoice numbers must be input into the accounts payable module (if available) so that duplicate invoice numbers can be identified

- Immediately cancel or note vendor invoices upon payment

- Invoice approval and delivery of signed check will not be made by the same person

- Vendor payment history should be periodically reviewed for irregularities

- Controls Over Corporate Credit Cards

- Issuance of Corporate Credit Cards will be limited

- Each card holder will have limits as to what the card may be used for (no personal use of the card is allowed).

- Agency cardholders will be notified of the rules and responsibilities associated with the card

- Credit Card statements will be reviewed by the finance committee for unusual or inappropriate charges

- Cardholders must submit supporting receipts and invoices with each purchase

- When credit card abuse is suspected the card privilege will be immediately suspended pending investigation

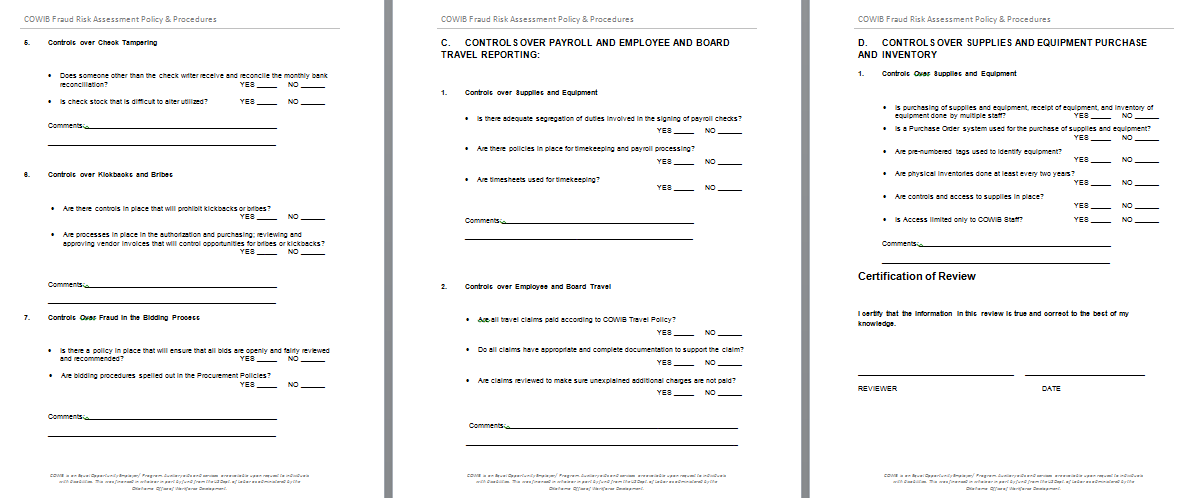

- Controls Over Check Tampering

- Someone other than the check writer will receive and reconcile the monthly bank reconciliation

- Check stock that is difficult to alter will be utilized

- Controls Over Kickbacks and Bribes

- Acceptance of kickbacks or bribes violates COWIB’s code of conduct and is not acceptable

- Multiple employees will be involved in the processes of authorizing purchases and reviewing and approving vendor invoices for payment.

- Controls Over Fraud in the Bidding Process

- COWIB has a policy that requires all purchases over the state threshold for competitive procurements shall be evaluated by a committee who will review and recommend all bids from vendors (bidders). No COWIB staff will participate in the evaluation process

- All bidding procedures are contained in COWIB’s Procurement Policies.

- Segregation of Duties to the extent possible

- Controls Over Payroll and Employee and Board Travel Reporting

- Segregation of Duties

- Authorized check signers will not prepare or sign their own checks

- Policies and procedures for timekeeping and payroll processing are contained in COWIB’s accounting procedures

- Electronic timesheets will be used as the timekeeping system of COWIB.

- Controls over Employee and Board Travel

- Travel claims will only be paid according to COWIB’s Travel Policy

- All Travel claims must have appropriate documentation to support the claim

- Travel claims will be reviewed to make sure unexplained additional charges are not added to the travel claim.

- Segregation of Duties

- Control for Supplies and Equipment Purchase and Inventory

- Controls over Supplies and Equipment

- Purchasing of supplies and equipment, receipt of equipment, and inventory of equipment will be done by multiple staff for internal control

- Purchases of supplies will be authorized by the CEO and/or COO

- Pre-numbered tags will be used to identify equipment

- Physical inventories will be conducted at least every two years as required by OMB Circulars

- COWIB will maintain physical controls over supplies and disbursement of supplies

- Access to supplies will be limited to COWIB personnel and contracted service provision staff.

- Controls over Supplies and Equipment

Equal Opportunity and Nondiscrimination Statement

All Recipients, and Sub-recipients / Sub-grantees must comply with WIOA’s Equal Opportunity and Nondiscrimination provisions which prohibit discrimination on the basis of race, color, religion, sex (including pregnancy, childbirth, and related medical conditions, transgender status, and gender identity), national origin (including limited English proficiency), age, disability, political affiliation or belief, or, for beneficiaries, applicants, and participants only, on the basis of citizenship status or participation in a WIOA Title-I financially assisted program or activity.

Addenda / Revisions

The COWIB Chief Executive Officer is authorized to issue additional instructions, guidance, forms, etc., to further implement these procedures.

Questions about these procedures may be directed to the COWIB’s Policy Analyst at (405) 622-2026.

Please click the download button at the top of the page to view additional attachments.