Self-Sufficiency Policy

Approved and Published: July 2024

Purpose

The purpose of this policy is to provide guidance and establish the self-sufficiency standard for Workforce Innovation Opportunity Act (WIOA) Adults and Dislocated Workers. The information included will assist with the calculation of income levels to determine eligibility for participation in various state and federally funded programs and to prioritize services when funding is limited.

Authority

The authority for this policy is derived from the following:

- Federal Register /Vol. 89, No. 11 /Wednesday, January 17, 2024 /Notices

- WIOA Public Law 113-128, Section 3(36)(A)(B);

- WIOA Public Law 113-128, Section 127(b)(2)(C);

- WIOA Public Law 113-128, Section 132(b)(1)(B)(v)(IV);

- Workforce System Operations Memo #01-2024

- Workforce System Directive (WSD) #80-2024

Background

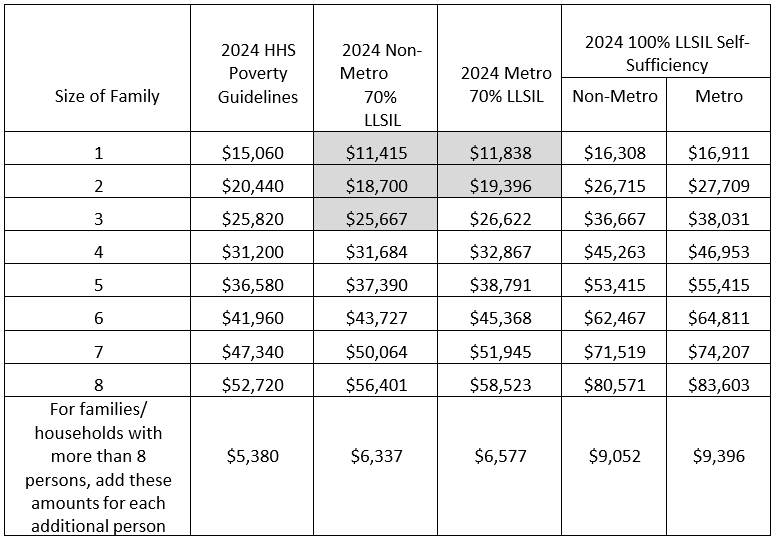

WIOA defines the term “low income individual” for eligibility purposes in terms of the poverty line or LLSIL for state formula allotments. The included table incorporates the 2024 figures outlined in Workforce System Operations Memo #01-2024 to be used by the governor and local workforce development boards to determine eligibility for adults, for certain services, low income program eligibility, participation in various state and federally funded programs, and prioritization of services when funding is limited is determined by a total family income that does not exceed the higher level of the poverty line or 70% of the LLSIL. In addition, as required by Workforce System Directive (WSD) #80-2024, the LWDB’s self-sufficiency policy must address the area’s procedures for serving adults and dislocated workers determined to be underemployed by local area standards.

A. Lower Living Standard Income Levels (LLSIL)

LLSIL – WIOA Section 3(36)(B) defines Lower Living Standard Income Levels (LLSIL) as “that income level (adjusted for regional, metropolitan, urban and rural differences and family size) determined annually by the Secretary [of Labor] based on the most recent lower living family budget issued by the Secretary.”

The 100% LLSIL is used to determine the minimum level for establishing self-sufficiency criteria at the local level.

B. Metropolitan Statistical Analysis Counties Include:

- Canadian

- Cleveland

- Lincoln

- Logan

- Oklahoma

C. Non-Metropolitan Counties Include:

- Hughes

- Okfuskee

- Pottawatomie

- Seminole

2024 Poverty Income Guidelines

D. Instructions

Use the above tables to determine economically disadvantaged status according to family size.

Where the poverty level for a particular family size is greater than the corresponding 70 percent of the LLSIL figure, the figure is shaded.

The 100% LLSIL is used to determine self-sufficiency as noted at Section 3 (36)(A)(ii) and Section 3 (36)(B) of WIOA.

These poverty guidelines are effective May 28, 2024.

Local Policy

A. Wage

The COWIB has set the Self-Sufficiency threshold at $26.00 per hour in full-time employment. ($54,080 annually) This standard will be used to determine an Adult or Dislocated Worker’s eligibility for career and training service programs.

B. Underemployment Determination

Consistent with Workforce System Directive (WSD) #80-2024, Adult and DLW funds may provide career and training services to underemployed individuals according to the priority of service requirement. Individuals who are underemployed may include those who are:

- Employed less than full-time who are seeking full-time employment;

- Employed in a position that is inadequate with respect to their skills and training;

- Employed and meet the definition of a low-income individual; and

- Employed with current earnings that are insufficient when compared to the individual’s previous earnings from previous employment, per local policy.

The USDOL Fair Labor Standards Act (FLSA) does not define full-time employment or part-time employment. According to Workforce System Directive (WSD) #80-2024, the minimum number of hours that constitute full-time employment is generally defined by the employer, but may not be less than an average of at least 30 hours per week, or 130 hours per month. Full-time employment often includes benefits not typically offered to part-time or temporary workers, such as annual leave, sick leave and health insurance. The attainment of self-sufficiency often depends on the availability of sick leave and health insurance.

C. Procedure

The WIOA employment and training programs mandate a universal access one-stop system with a tiered approach to service delivery. When an employed registrant is unable to obtain or retain employment that leads to self-sufficiency, documentation must be collected to prove the Adult and Dislocated Worker’s per hour earned wages were at or below $26.00 per hour prior to enrollment into training.

D. Additional Criteria

The Career Navigator must indicate in the Oklahoma Works designated state case management system in Program Case Notes the existing condition which determines a need for services and the source document which validates such condition.

Additional criteria and acceptable source documentation that an individual is not meeting self- sufficiency guidelines are listed below:

- Individual’s income for the past six months does not exceed the higher level of the poverty line or 70% of the LLSIL (Verify both wages and number in family.)

- Pay Stubs

- Employer statement or contact

- Quarterly estimated tax for self-employed person

- Applicant statement

- Individual currently receives or has received in the past six months any income-based assistance such as food stamps or Section 8 housing.

- Public assistance records

- Housing authority records

- SSI records

- Current employee does not regularly exceed 30 hours per week (130 hours per month)

- Pay Stubs

- Employer statement or contact

- Employment History from Individual Employment Plan (IEP)

- Applicant statement

- Current wage projection does not exceed $54,080 per year.

- Pay Stubs

- Employer statement or contact

- Quarterly estimated tax for self-employed

- Applicant statement

- Employment History from IEP

- Current employment is temporary.

- Employer statement or contact

- Applicant statement

- Pay Stub

Equal Opportunity and Nondiscrimination Statement

All Recipients, and Sub-recipients / Sub-grantees must comply with WIOA’s Equal Opportunity and Nondiscrimination provisions which prohibit discrimination on the basis of race, color, religion, sex (including pregnancy, childbirth, and related medical conditions), national origin (including limited English proficiency), age, disability, political affiliation or belief, or, for beneficiaries, applicants, and participants only, on the basis of citizenship status or participation in a WIOA Title-I financially assisted program or activity.

Addenda / Revisions

The COWIB Executive Director is authorized to issue additional instructions, guidance, approvals and/or forms to further implement the requirements of policy, without making substantive change to the policy, except in situations when a new or updated state and federal guidance is issued.