How Can We Help?

Supplemental Wage Data Collection

Approved and Published: December 19, 2018

PURPOSE

As indicated by OWDI 07-2018, Local Workforce Development Boards must develop written processes and procedures for supplemental wage data collection in their local areas. It is our understanding that the written processes and procedures are intended to apply to WIOA Title I Programs as well as to Wagner-Peyser Employment Services as amended by Title III.

AUTHORITY

The authority for this policy derives from Section 116 of the Workforce Innovation and Opportunity Act (WIOA) and from OWDI #07-2018, “Supplemental Information Collection” policy. Additional sources include:

• Federal Register/Vol. 81. No.161, Parts 677

• U.S. Department of Labor/Employment and Training Administration Training and Employment Guidance Letter (TEGL) 26-16

• U.S. Department of Labor/Employment and Training Administration Training and Employment Guidance Letter (TEGL) No. 10-16

• OWDI #21-2017, Change 1

BACKGROUND

To a large degree, WIOA performance indicators are defined by measures that are related to a participant’s employment status after exit from the program. So, to establish a reliable picture of WIOA program performance, it is necessary to have accurate data on post-exit employment outcomes of participants. These requirements are given in state and federal guidance.

Requirements of the WIOA Law. Section 116 of WIOA establishes performance accountability indicators and performance reporting requirements to assess the effectiveness of States and local areas in achieving positive outcomes for the individuals served.

Section 116(b)(2)(A)(i) states:

IN GENERAL. – The State primary indicators of performance…shall consist of-

(I) The percentage of program participants who are in unsubsidized employment during the second quarter after exit from the program;

(II) The percentage of program participants who are in unsubsidized employment during the fourth quarter after exit from the program;

(III) The median earnings of program participants who are in unsubsidized employment during the second quarter after exit from the program;

(IV) The percentage of program participants who obtain a recognized postsecondary credential, or a secondary school diploma or its recognized equivalent (subject to clause (iii)), during participation in or within 1 year after exit from the program;

(V) The percentage of program participants who, during a program year, are in an education or training program that leads to a recognized postsecondary credential or employment and who are achieving measurable skill gains toward such a credential or employment; and

(VI) The indicators of effectiveness in serving employers established pursuant to clause (iv).

These measures are applicable to:

WIOA Title I-B activities – Adult and Dislocated Worker programs;

WIOA Title II activities – Adult Education and Literacy;

WIOA Title III – Employment services program authorized under the Wagner-Peyser Act, and

WIOA Title IV – The program authorized under title I of the Rehabilitation Act of 1973.

Additionally, Section 116(b)(2)(A)(ii) of the Joint Rule provides a list of the primary indicators for the WIOA Title I Youth program:

(ii) PRIMARY INDICATORS FOR ELIGIBLE YOUTH. –

The primary indicators of performance for the youth program authorized under chapter 2 of subtitle B shall consist of –

(I) The percentage of program participants who are in education or training activities, or in unsubsidized employment, during the second quarter after exit from the program;

(II) The percentage of program participants who are in education or training activities, or in unsubsidized employment, during the fourth quarter after exit from the program; and

(III) The primary indicators of performance described in subclauses (III) through (VI) of subparagraph (A)(i).

Several of the performance accountability indicators listed above are based on employment-related data. For example, in WIOA Youth program, we look at the percentage of program participants who are in education or training activities, or in unsubsidized employment, during the second quarter and the fourth quarter after exit from the program.

In the other core programs, employment-related measures include:

The percentage of program participants who are in unsubsidized employment during the second quarter after exit from the program;

The percentage of program participants who are in unsubsidized employment during the fourth quarter after exit from the program;

The median earning of program participants who are in unsubsidized employment during the second quarter after exit from the program.

The Credential Attainment indicator (given in WIOA Section 116(b)(2)(a)(i)(V)) also has an employment-related component. Here is how the Credential Attainment indicator is described in TEGL 26-161

“d. Credential Attainment: The percentage of those participants enrolled in an education or training program (excluding those in on-the-job training (OJT) and customized training) who attain a recognized postsecondary credential or a secondary school diploma, or its recognized equivalent, during participation in or within one year after exit from the program. A participant who has attained a secondary school diploma or its recognized equivalent is included in the percentage of participants who have attained a secondary school diploma or its recognized equivalent only if the participant is also employed or is enrolled in an education or training program leading to a recognized postsecondary credential within one year after exit from the program.”

All of these WIOA performance indicators are related, in one way or another, to a participant’s employment status after exit from the program. It is necessary to have accurate data on post-exit employment outcomes of participants in order to establish a reliable picture of WIOA program performance.

Requirements of the WIOA Joint Rule. In terms of measuring a local area’s performance on the employment-related indicators, the WIOA Joint Rule specifies that, in general, quarterly wage record information must be used. However, the Joint Rule also recognizes that there are instances when quarterly wage records are not available for a participant. In those cases, other information may be used.

Here is the statement from §677.175:

§677.175 What responsibility do States have to use quarterly wage record information for performance accountability?

(a) (1) States must, consistent with State laws, use quarterly wage record information in measuring a State’s performance on the primary indicators of performance outlined in §677.155 and a local area’s performance on the primary indicators of performance identified in §677.205

(2) The use of social security numbers from participants and such other information as is necessary to measure the progress of those participants through quarterly wage record information is authorized.

(3) To the extent that quarterly wage records are not available for a participant, States may use other information as is necessary to measure the progress of those participants through methods other than quarterly wage record information.

When quarterly wage records are not available for a participant, as noted in paragraph (a)(3) of §677.175, states may use “other information as is necessary” to measure the progress of the participants. The “other information” is Supplemental Wage Data.

Other Federal Guidance (U.S. Department of Labor and U.S. Department of Education). More information about Supplemental Wage Data, including guidance for the collection of Supplemental Wage Data, is given in TEGL 26-16, “Guidance on the use of Supplemental Wage Information to implement the Performance Accountability Requirements under the Workforce Innovation and Opportunity Act.”

This statement from TEGL 26-16 describes the collection of supplemental wage data as a “follow up” process:

“…For purposes of calculating levels of performance for the employment rate indicators, States must collect data on participants’ employment status during the second and fourth quarters after the participant exits the program and, for purposes of calculating levels of performance for the median earnings indicator, States must collect data on participants’ wages during the second quarter after exit from the program. Follow-up to collect supplemental wage information may be conducted by the State, local programs, or a third-party contractor. The timing for collecting supplemental wage information may vary based on whether the agency knows or expects that UI wage data will not be available for a participant following the exit from a program.”

State Guidance. To implement the requirements of Section 116 in accordance with TEGL 26-16, the Oklahoma Office of Workforce Development has issued OWDI 07-2018, “Supplemental Information Collection,” published on June 12, 2018.

Pursuant to the “Purpose” statement of OWDI 07-2018, the state policy provides guidance for the use of supplemental information within the Oklahoma Works workforce development system for the Chief Local Elected Officials (CLEOs) and the Local Workforce Development Boards (LWDBs) in carrying out the performance accountability requirements under WIOA section 116.

As described on Page 2 of OWDI 07-2018, Oklahoma will use UI quarterly wage record information as the primary data source for measuring program performance on the employment-related performance indicators. This is consistent with the requirement on § 677.175(a)(1). Supplemental wage data will be collected “as necessary.”

Excerpt from OWDI 07-2018:

“Direct Unemployment Insurance (UI) wage match, obtained through either State UI data or the out-of-State wage record data exchange, via appropriate data sharing agreement, will be the primary data source for verifying participant outcomes for purposes of calculating levels of performance for the employment-related indicators and will be used when available.”

“Supplemental information obtained from either the participant or the participant’s employer may be utilized to collect employment-related data as necessary for calculating levels of performance.”

OWDI 07-2018 goes on to say that supplemental information may be acquired in an interview by program staff with the participant or the participant’s employer (with a signed consent form).

LOCAL POLICY

Scope

As indicated by OWDI 07-2018, Local Workforce Development Boards must develop written processes and procedures for supplemental wage data collection at their local levels. It is our understanding that the written processes and procedures are intended to apply to WIOA Title I Programs as well as to Wagner-Peyser Employment Services as amended by Title III. In the event that a participant is co-enrolled, the program that is providing the training or education services will be responsible for the supplemental information collection during the participant’s required follow-up timeframe.

The process described herein will apply to staff who are conducting supplemental wage information collection in the following programs:

WIOA Title I-B Adult;

WIOA Title I-B Dislocated Worker;

WIOA Title I-B Youth; and

WIOA Title III Wagner-Peyser Employment Services

A. SUPPLEMENTAL WAGE DATA COLLECTION

A.1 HOW INDIVIDUALS WILL BE INFORMED AT PROGRAM ENTRY REGARDING SUPPLEMENTAL WAGE REQUIREMENTS

Informing the Participant about the Supplemental Wage Data Collection Survey. At program entry, program staff shall inform each participant about the post-exit Supplemental Wage Data Collection Survey. This information may be imparted in several different ways:

(a) During a group meeting or during an individual meeting with the participant, a program staff member may inform the participant orally about the post-exit survey.

(b) Via telephone, a staff member may advise the participant about the survey via a personal conversation or through a voice message.

(c) Via email / text / social media, a staff member may advise the participant in writing about the post-exit survey.

As with any good communications process, repetition is always useful in order to reinforce an important message. So, program staffers are encouraged to use any or all of the communications strategies listed above.

Suggested Wording of the Message:

Your long-term success in the workforce is important to us. Because of this, and because of our commitment to continuous quality improvement, you may be invited in the future to participate in a follow-up survey to collect information about your employment status and wages.

[Participant Expectations]. Your participation in the survey is voluntary, and any information that you share with us will be kept strictly confidential. There will be no penalty for failure to participate. It is possible that you won’t be selected to participate in the survey. If you don’t receive an invitation to participate, it will not be a reflection on you or your career choices or your program experience. It simply means that we determined that your data is not necessary.

[Required Documentation]. If you are selected to participate in the survey, we may ask you to provide documentation to confirm your employment status and earnings. For example, you might be asked to provide a self-employment worksheet or copies of pay stubs or another form of written confirmation. We ask for this information in order to maintain our high standards of data quality.

[Timeframe]. If you are selected to participate in this survey, you will be contacted within 6 to 12 months after the last service you receive from our Oklahoma Works program. The survey will be conducted by a partner in the Oklahoma Works system.

Our success is measured by your future employment and earnings. Please help us out by participating in the survey if you are asked. Thank you!

The message described above may be altered / varied / revised / improved. However, as required by OWDI 07-2018, the information provided to individuals must include: “…participant expectations, required documentation, and collection timeframes.”

A.2 STEPS TO DETERMINING WHICH PARTICIPANTS SHOULD BE INCLUDED IN THE SUPPLEMENTAL WAGE INFORMATION COLLECTION PROCEDURE

Not all participants will be included in the supplement wage information collection procedure.

In fact, many participants will be excluded from the supplemental wage survey. For example, a participant will be excluded if it is determined that there is a direct wage match for the participant in Oklahoma’s UI Wage Record.

On the other hand, some workers will have earnings that are not included in the UI Wage Record. Our supplemental wage data procedure will focus on these four participant groups in particular:

(a) Individuals who opted not to disclose their Social Security Number during their program participation.

Without a Social Security Number, it is not possible to retrieve data on an individual’s UI wages during the second and fourth quarters after the participant’s exit from the program.

Therefore, if the program has no record of a participant’s Social Security Number, then the participant should be included in the supplemental wage data collection process.

(b) Participants whose career goal is self-employment or whose career path is likely to lead to work as a self-employed person (business owner, independent contractor, etc.).

Self-employed workers are found in a wide range of occupations. Some common occupational classifications for self-employed workers are:

• Carpenters • Property Managers

• Carpet Installers • Management Analysts

• Painters • Insurance Agents

• Construction Managers • Real Estate Brokers

• Dentists • Street Vendors

• Architects • Farm Managers

• Physicians • Chief Executives

• Lawyers

According to the Bureau of Labor Statistics, self-employed workers tend to be more commonly found within construction and extraction occupations (15.9 percent); management, business, and financial occupations (11.2 percent); and sales and related occupations (8.8 percent).

Barbers and cosmetologists often work as independent contractors rather than wage-earning employees.

So, if the program determines that a participant’s training plan or career goal is likely to lead to self-employment, then the participant should be included in the supplemental wage data collection process.

(c) Participants whose career goal or career path is likely to lead to “non-covered” employment.

The term “non-covered” employment refers to work that is not covered by the states’ Unemployment Insurance program. In Oklahoma, covered employers pay in to the state’s UI fund – but some types of employment aren’t covered by the law. For example, the term “non-covered” employment may refer to work performed by an employee of a church or convention or association of churches. It may also include work performed in an elementary or secondary school which is operated primarily for religious purposes.

If you are a “duly ordained, commissioned or licensed minister of a church,” then the work you perform in the exercise of your ministry is not considered to be “employment” (for the purpose of establishing your eligibility for UI payments).

Also, you’re not counted as a covered employee for UI purposes if you are:

o An elected official;

o A member of a legislative body, or a member of the judiciary of a state or political subdivision; or

o A member of the State National Guard or Air National Guard

There are other exceptions as well.

If a participant’s training plan or career goal is likely to lead to work in “non-covered” employment, then the participant should be included in the supplemental wage data collection process.

(d) Other individuals for whom a quarterly wage record match would not be available through the State UI data system.

As described in TEGL 26-16, state UI data systems are limited in the scope of information that is collected:

“Individuals for whom a quarterly wage record match would not be available through the State UI data system include but are not limited to:

• Federal employees;

• Military employees; or

• Individuals who are self-employed.”

So, if the program determines that a participant’s training plan or career goal is likely to lead to employment in the military or in the federal government, then the participant should also be included in the supplemental wage data collection process.

A.3 A SPECIFIC SUPPLEMENTAL WAGE INFORMATION COLLECTION PROCESS

To improve the quality and quantity of data collected through this process, the U.S. Department of Labor offers this recommendation in TEGL 26-16:

“Best practice tip: Inform participants at program entry about the supplemental wage information follow-up process and collect extensive contact information about them, such as addresses and phone numbers of relatives or others who may know the participants’ whereabouts over time and employment information, if applicable.”

Basic contact information will be collected as part of the normal participant enrollment process. For example, the following data is collected at program registration:

• Address

• Phone Number

• Email Address

• Alternate Contact Person

In the course of delivering services to a participant, program staff may ask the participant to voluntarily disclose additional information which may be recorded in Program Notes. Additional information may include:

• How to contact the participant through social media;

• Whether the participant agrees to be contacted through text messaging; and

• Addresses and phone numbers of relatives or others (friends, employers, etc.) who may know the participants’ whereabouts over time.

To the extent possible, this additional contact information should be captured in the participant’s service record.

OWDI 07-2018 requires local procedures to include the following specific elements:

a. Locating or maintaining contact with the individual or employer and securing his/her cooperation.

b. What to say to former participants or their employers to encourage cooperation with voluntary and truthful disclosure.

c. Collection of accurate information, collection timeframes, required documentation, and documentation procedures.

NOTE: In implementing these elements, program staffers are encouraged to refer to the forms and instructions given in OWDI 07-2018 for additional information.

(a) Locating or maintaining contact with the individual or employer and securing his / her cooperation.

(b) Data Preference

In Central Oklahoma, our preference will be to obtain the supplemental wage data directly from the participant if possible. Therefore, the first effort to complete the survey should begin with outreach to the participant.

If the participant cannot be reached (or is unresponsive to outreach efforts), program staff may then seek to complete the supplemental wage survey by reaching ot to the participant’s last known employer.

(c) Documenting Attempts to Contact the Participant

Staff should reach out to the participant using any method that has worked successfully in the past to contact the participant – telephone, email, social media, etc.

Each attempt to reach out to the participant should be recorded in the case notes. The purpose of this is to document the number of attempts, the contact method that was tried, as well as other pertinent information.

• The date and time of the attempt;

• Any response that was received;

• etc

If a phone call was placed, was the call completed? Did anyone answer the call? Was a message left? All of these details will help to describe the outreach attempts that were made.

If it is not possible to collect the supplemental wage data from the participant after a reasonable number of attempts, then the program staff may seek to complete the supplemental wage survey by reaching out to the participant’s last known employer.

(d) Verifying the Participant’s Identity

To verify the participant’s identity, the interviewer should ask the participant to provide a snippet of confidential information that would be known by the participant (but probably not known by an imposter.) Potential questions include: (a) Provide the last 4 digits of your Social Security Number; (b) Verify your address; or (c) What is your date of birth?

If the outreach effort is successful and the participant is contacted, the collection of data may proceed using the WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form that is given as Attachment L to OWDI #21-2017, Change 1, “Oklahoma Data Validation and Source Documentation Requirements.” (Attachment A)

The form describes, in a step-by-step format, the questions that should be asked. Here is a sampling of the questions:

• Since the end of your program, have you enrolled in any postsecondary educational or training programs?

• Are you currently employed?

• Is the job related to any education/training you received during the program you attended?

Other questions are asked as well.

(e) Reaching out to the Participant’s Last Known Employer

If it is not possible to collect the supplemental wage data from the participant after a reasonable number of attempts, then the next step is to reach out to the participant’s last known employer.

Collecting supplemental wage data from the last known employer is not the most preferable option. Generally speaking, the participant is the best source of information about his / her employment status and earnings. The last known employer may have information about wages that were paid to the participant, but the information might be incomplete.

In any case, if contact with the participant is not possible, OWDI 07-2018 permits program staff to collect supplemental wage data from the participant’s employer. So, as a last resort, our local process will allow contact with the employer after a reasonable number of attempts to reach the participant have been made and documented.

(f) What to say to former participants or their employers to encourage cooperation with voluntary and truthful disclosure

The Supplemental Wage Data Collection process is built upon the goodwill of the participants and employers who voluntarily cooperate in the data collection interview. A basic presumption is that participants and employers will be willing to cooperate in this process out of a sense of reciprocity – recognizing that information is being freely given by the participant (or employer) in an informal exchange for the value of services delivered by the workforce system.

Before beginning the data collection interview, an introductory message should be offered to the participant or employer. The message should be carefully crafted, and it should include the following elements:

1) The interviewer should introduce himself / herself and briefly describe the purpose of the contact. It may be helpful to remind the participant that s/he was informed at program entry about the supplemental wage data collection survey. We want to emphasize that the over-arching purpose of the interview is to support our program’s commitment to continuous quality improvement.

2) The interviewee should be reminded: “Your participation in the survey is voluntary, and any information that you share with us will be kept strictly confidential. There will be no penalty for failure to participate.” (This reminder is intended to put the interviewee at ease and allay any fears they might have about participating in the survey).

3) The interviewer should remind the participant of the services they received through the workforce system – including, as appropriate, references to specific services, timeframes, and locations. (This reminder is intended to encourage the interviewee’s sense of loyalty to and solidarity with the purpose of the workforce system).

4) The interviewer should briefly describe the types of questions that will be asked – questions related to the participant’s employment status and earnings in the second and fourth quarters after program exit.

5) The participant (or employer) should be advised about the average expected time required to complete the interview. If the interviewee indicates that s/he does not have time at present to complete the interview, then another time may be scheduled in the future that is more convenient to complete the interview questions.

6) Additionally, before beginning the interview, the interviewee should be thanked – in advance – for their participation in the survey. We want to emphasize our commitment to seeking honest and truthful information about the participant’s post-program experience. Again, our purpose is to evaluate the effectiveness of our program services.

Collection of accurate information, collection timeframes, required documentation, and documentation procedures.

The interviewer should lead the participant (or employer) through the interview questions in the order they are given in the WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form. Each program should assign a data collection supervisor to carefully manage the intricate details of the interviewing process.

Collection of Accurate Information. There are a dozen or so questions on the form. The interviewee should be asked to answer each question to the best of their ability.

The first two questions on the form are designed to collect information about the participant’s enrollment in any postsecondary education or training programs. Question 1 reads as follows:

“Since the end of your program, have you enrolled in any postsecondary educational or training programs?”

This question is particularly relevant to any participant who was enrolled in the WIOA Title I Youth program. The question will need to be answered by the participant.

NOTE: If the interviewee is the participant’s last known employer, the interviewer should skip this question.

For former participants of the WIOA Title I Youth program, the answer to this question will be directly related to this primary indicator of performance for the Youth program:

“The percentage of program participants who are in education or training activities, or in unsubsidized employment, during the second quarter after exit from the program.”

The question has less relevance if the participant was in one of the other WIOA Core programs. Even so, the participant’s answer to the question has value, and it should be collected.

If the participant indicates that s/he has enrolled in a postsecondary education or training program, then Question 2 should also be asked:

In what type of class or classes have you enrolled? (Check all that apply.)

• Adult Workforce Education/Job Training/Career Center/Skilled Trades Program

• College

• Other (Specify)

• Do not know or Prefer not to answer

The next set of questions is in a section titled, “Employment (Supplemental Wage Verification).” This set of questions may be answered by the participant or by the participant’s last known employer.

Here are the questions in the Employment (Supplemental Wage Verification) section of the WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form:

EMPLOYMENT (SUPPLEMENTAL WAGE VERIFICATION)

- Are you currently Employed? ☐ Yes ☐ No

- Since completing our program, please select the 3-month period(s) you have been employed.

☐ January to March ☐ April to June

☐ July to September ☐ October to December - Place of Employment during the previous 3-month period:

Employer: Type of Employment: _

Employer FEIN (if known): _____________

- Is the job related to any education/training you received during the program you attended?

☐ Yes ☐ No

- Approximately how many hours do you work each week?

_ Hours

- Wage during the previous 3-month period of employment: $__________

☐hourly ☐weekly ☐monthly ☐yearly

- Reason for Unemployment.

☐ Insufficient Employment Opportunity

☐ Self-Employed/Lack of Work

☐ Military relocation

☐ Unemployed due to Termination/Layoff

☐ Unemployed due to permanent closure/substantial layoff at place of employment

☐ Other

☐ Prefer Not to Answer

Collection Timeframes. The timeframe for data collection is given in OWDI 07-2018, “Supplemental Wage Information Collection.”

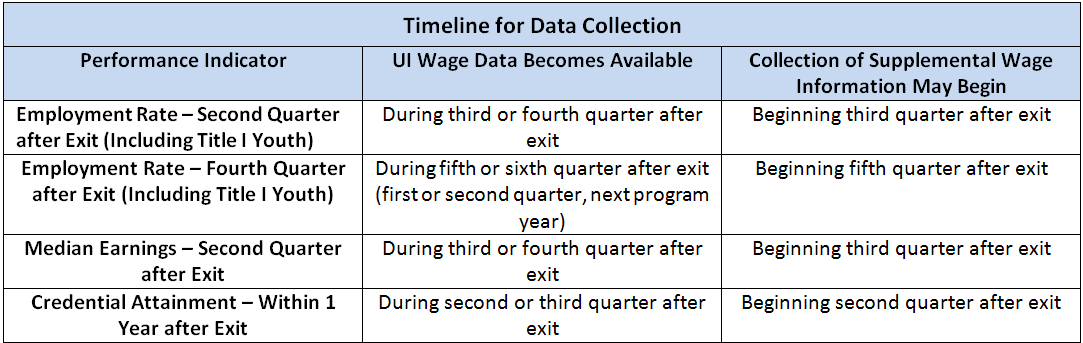

On Page 3 of OWDI 07-2018, the following table is given:

For the purpose of our Local Process in Central Oklahoma, the collection of Supplemental Wage information will begin in the third quarter after program exit.

The third quarter interview is designed for two particular purposes:

• For participants in the WIOA Title I Youth program, the interview will collect information about the number of participants who are in education or training activities, or in unsubsidized employment, during the second quarter after exit; and

• For participants in other WIOA Core Programs, the interview will help to determine the percentage of program participants who are in unsubsidized employment during the second quarter after exit from the program.

In the fifth quarter after exit, interviews should be administered to former participants in order to collect information about their employment status in the fourth quarter after exit.

Following the timeline given above, it is easy to see that some participants may be interviewed in both the third and the fifth quarters after exit.

In terms of the exact timeframe for conducting the interviews, they may begin as soon as the new quarter begins.

It will require some effort to manage the data collection process. In particular, the data collection supervisor will need to review the employment and earnings information in the UI Wage Record as soon as it becomes available each quarter.

Not all participants will be included in the supplement wage information collection procedure. In fact, as noted, many participants may be excluded from the supplemental wage survey if it is determined that there is a direct wage match for the participant in Oklahoma’s UI Wage Record.

UI Wage Records are not available immediately after the close of a quarter. As described in TEGL 26-16, UI data is “time-lagged.” This can make it difficult to know, for sure, how many participants need to be in the data collection procedure.

“The optimal time to collect supplemental wage information is as soon as possible following the close of the second and fourth full quarters after exit.” TEGL 26-16

Required Documentation. The requirements for documentation are given in OWDI 07-2018. Additionally, there is a cross-reference to OWDI 21-2017, Change 1: “Oklahoma Data Validation and Source Documentation Requirements.”

As stated in OWDI 07-2018:

One Acceptable Source Document for supplemental wage information listed below must be uploaded into the participant’s case file in OKJobMatch as an Enrollment documentation item type and a Validation document type for the applicable enrollments.

Tax documents, payroll records, and employer records such as:

Copies of quarterly tax payment forms to the Internal Revenue Service, such as a Form 941 (Employer’s Quarterly Tax Return);

Copies of pay stubs (minimum of two pay stubs); or

Signed letter or other information from employer on company letterhead attesting to an individual’s employment status and earnings.

Other supplemental wage records:

Income earned from commission in sales or other similar positions;

Automated database systems or data matching with other partners with whom data sharing agreements exist;

WIOA Partner’s administrative records that contain required employment and wage information, such as current records of eligibility for programs with income-based eligibility (e.g., Temporary Assistance for Needy Families (TANF) or Supplemental Nutrition Assistance Program (SNAP); or

WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form, reference the current source documentation policy;

Self-employment worksheet signed and attested to by program participants, reference the current source documentation policy. Earnings (or net profit) can be calculated by subtracting total expenses from gross receipts. Not all self-employed individuals receive a salary, but the funds that represent income over expenses that are available to be invested back into the business are considered earnings.

The collection of appropriate documentation is, perhaps, the most challenging aspect of the Supplemental Wage Date Collection Process.

The good news is that only one acceptable source document must be collected (as described above).

To collect the source document, one of several methods may be used —

If the source document is a WIOA Partner administrative record, then the source document may be collected in the form of a copy (paper or electronic) of the program record. An electronic copy should be uploaded into the participant’s case file in OKJobMatch. The source document may be a report, a print-out, a screenshot, etc., captured from the WIOA Partner’s administrative records.

If the source document is a WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form, then no further source documents must be collected as long as the interviewer: (a) Accurately records the information that was provided by the participant (or employer); and (b) Completes the “Staff Use Only” portions of the form.

The WIOA Participant Supplemental Wage Quarterly Exit Data Collection Form may be used if the participant received wages from an employer during the reference quarter. For example, if the participant was employed by a non-covered employer, then this data collection form should properly be used to gather information about the participant’s employment status, earnings, etc.

On the other hand, if the participant had self-employment income (as opposed to wages), then the Supplemental Wage Self-Employment Verification Form should be used. (Attachment B)

If the source document is a Supplemental Wage Self-Employment Verification Form, then no further source documents must be collected. However, the participant must sign the following statement:

I, _____, certify that the information stated above is true and accurate, and there is no intent to commit fraud. I am aware that the information I have provided is subject to review and verification, and that I may be required to document its accuracy.

The interviewer must collect a copy of the signed form from the participant. The participant may send the document to the interviewer via postal mail, fax, or email. Alternately, the interviewer may provide a website where the participant may upload a copy of the signed Supplemental Wage Self-Employment Verification Form.

If the source document is any other type of record or report provided by the participant – pay stubs, tax payment forms, etc. – then an electronic copy must be uploaded into the participant’s case file in OKJobMatch. The participant may send the document to the interviewer via postal mail, fax, or email; or the interviewer may provide a website where the participant may upload a copy of the acceptable source document.

If the source document is any other type of record provided by the employer (rather than the participant), then an electronic copy must be uploaded into the participant’s case file in OKJobMatch. The employer may send the document to the interviewer via postal mail, fax, or email; or the interviewer may provide a website where the employer may upload a copy of the acceptable source document.

Regardless of which of the above methods are used to collect the required source documentation, there is one additional requirement that is given in OWDI 21-2017, Change 1. That is, the following information must be uploaded with the acceptable documentation:

• Quarter for which data is being collected

• O*NET code

• NAICS Code

• Employer FEIN

• Employer

• Company City

• Company State

• Total Earnings for Quarter

This requirement is stated on Page 31 of the “WIOA Title I Adult, Dislocated Worker, and the Wagner-Peyser Employment Service as amended by Title III Eligibility Source Documentation Guide” (which is part of OWDI 21-2017, Change 1).

COWIB interprets this requirement as follows:

Quarter for which Data is Being Collected. With the uploaded source document, include a statement describing the reference quarter for which the data was collected.

ONET code. If the participant was employed during the reference quarter, either as an employee or as a self-employed person, provide the O-NET code which corresponds to the participant’s job title. Find the most suitable code using the ONET Online webpage, https://www.onetonline.org/ . If the participant was not employed during the quarter, enter “N/A”.

NAICS Code. If the participant was employed during the reference quarter, provide the code number that corresponds to the industry in which the participant worked. Use the North American Industry Classification System that is given at https://www.census.gov/cgi-bin/sssd/naics/naicsrch?chart=2017 . Enter the 2-digit code number. If the participant was not employed during the quarter, enter “N/A”.

Employer FEIN. If the participant was employed during the reference quarter, either as an employee or as a selfemployed person, provide the employer’s FEIN number. “FEIN” refers to Federal Employer Identification Number. This is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities for the purposes of identification. The number is often called the Employer Identification Number (EIN) or the Federal Tax Identification Number (TIN). For a self-employed individual, this number might be the same as the person’s Social Security Number. If the participant was not employed during the quarter, enter “N/A.”

Employer. If the participant was employed during the reference quarter, provide the name of the employer. For a selfemployed individual, it is allowable to enter “Self Employed.” If the participant was not employed during the quarter, enter “N/A.”

Company City. Provide the city where the employer, if any, is located.

Company State. Provide the state where the employer, if any, is located.

Total Earnings for Quarter. Provide a statement of the participant’s total earnings during the quarter. “Earnings,” in this sense, includes gross wages that were actually earned by the participant during the quarter, not projected amounts. The amount includes the participant’s regular hours and earnings as well as any commissions, bonuses, gratuities, etc. (See “Additional Guidance,” below).

B. ADDITIONAL GUIDANCE FROM OWDI 07-2018

The following must be considered when collecting supplemental information for purposes of calculating levels of performance for the employment-related indicators:

It is required to report a participant’s status in unsubsidized employment during the second and fourth quarter after exit.

It is required to report a participant’s quarterly earnings during the second quarter after exit in order to calculate the median earnings performance indicator.

If supplemental wage information is used to determine employment status in the second quarter after exit, then supplemental wage information must be used to determine median earnings in the second quarter after exit. There are no requirements to use supplemental wage information across multiple reporting periods (second and fourth quarters after exit) in the event an individual’s employment status has changed.

OKJobMatch will utilize direct wage records when available for performance reporting even if supplemental wage information is available in the system, since direct wage match yields the most reliable data.

A participant’s quarterly earnings used for reporting the median earnings indicator second quarter after exit only reflects those wages that are actually paid to (or earned by) the participant during the quarter, not projected amounts, and is representative of the participant’s regular hours and earnings.

Wages include all compensation for services including commissions, bonuses, the cash value of all compensation in any medium other that cash, dismissal payments, gratuities received, and wages earned but not actually paid (i.e. distribution of an employer’s assets for the benefit of creditors or garnishment for child support payments, etc.)

Participants who do not have the necessary data to complete a wage record match and do not provide supplemental wage information are still included in the employment status performance calculations as a negative for the applicable quarter after exit.

Participants will be excluded from the median earnings indicator calculation if the employment rate second quarter after exit is a negative.

C. EQUAL OPPORTUNITY AND NONDISCRIMINATION STATEMENT

All Recipients, and Sub recipients / Sub-grantees must comply with WIOA’s Equal Opportunity and Nondiscrimination provisions which prohibit discrimination on the basis of race, color, religion, sex (including pregnancy, childbirth, and related medical conditions, transgender status, and gender identity), national origin (including limited English proficiency), age, disability, political affiliation or belief, or, for beneficiaries, applicants, and participants only, on the basis of citizenship status or participation in a WIOA Title-I financially assisted program or activity.

D. ADDENDA / REVISIONS

The COWIB Chief Executive Officer is authorized to issue additional instructions, guidance, forms, etc., to further implement these procedures.

Please click the download button at the top of the page to view additional attachments.

Questions about these procedures may be directed to the COWIB’s Policy Analyst at (405) 622-2026.